Related bodies corporate for payroll tax

Learn about what circumstances apply for corporations to be grouped.

Related bodies corporate that carry on a business are automatically grouped.

‘Corporation’ is defined in section 57A of the Corporations Act 2001 (Cwlth).

Corporations are related if any of the following apply:

- 1 corporation controls the board composition of another corporation

- 1 corporation can control more than 50% of votes in a general meeting of another corporation

- 1 corporation holds more than 50% of the share capital of another corporation.

The first corporation is called a holding company. The second corporation is called a subsidiary.

Any related bodies corporate are grouped, even if they have holding companies overseas.

Related bodies corporate cannot apply for an exclusion from the group.

Example

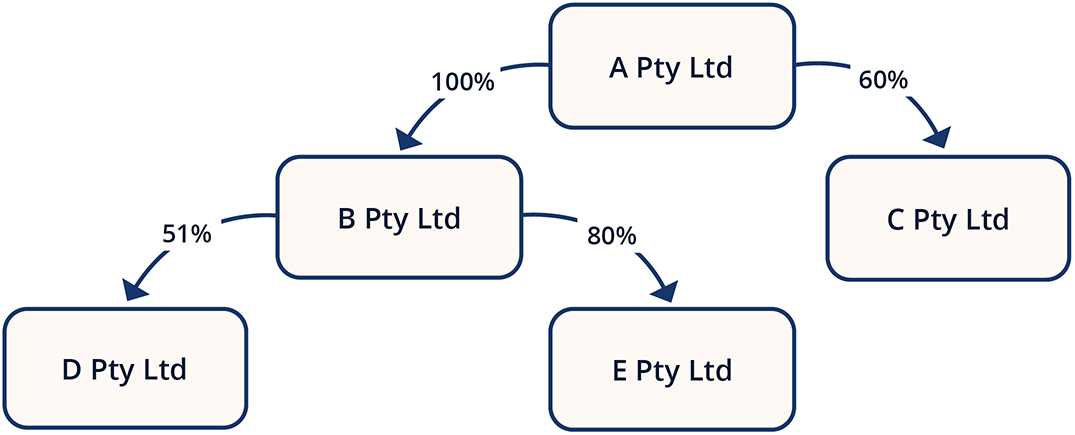

A Pty Ltd is the holding company of B Pty Ltd and C Pty Ltd, with more than 50% of the voting shares of each company. B Pty Ltd is the holding company of D Pty Ltd and E Pty Ltd. A Pty Ltd is the ultimate holding company.

All the companies in this example are grouped.