Groups formed through controlling interests for payroll tax

If a person has a controlling interest (more than 50%) in 2 or more businesses, those businesses are grouped. ‘Person’ includes an individual, a set of persons, a corporation, all bodies and associations (corporate, incorporated and unincorporated), and partnerships.

See the table to decide who has controlling interest for different business types.

| Business type | Who has controlling interest |

|---|---|

| Corporation | A person who is entitled to exercise more than 50% of the voting power:

|

| Body corporate or unincorporate | A person, or set of persons, who constitutes more than 50% of the management board, or controls the composition of the board |

| Partnership | A person who:

|

| Trust | A person who is a beneficiary of more than 50% of the value of the interest in the trust that carries on the business

Under a discretionary trust, all beneficiaries are deemed to have a controlling interest |

| Sole owner | Either:

|

Different business types can be grouped if the same person or set of persons has a controlling interest.

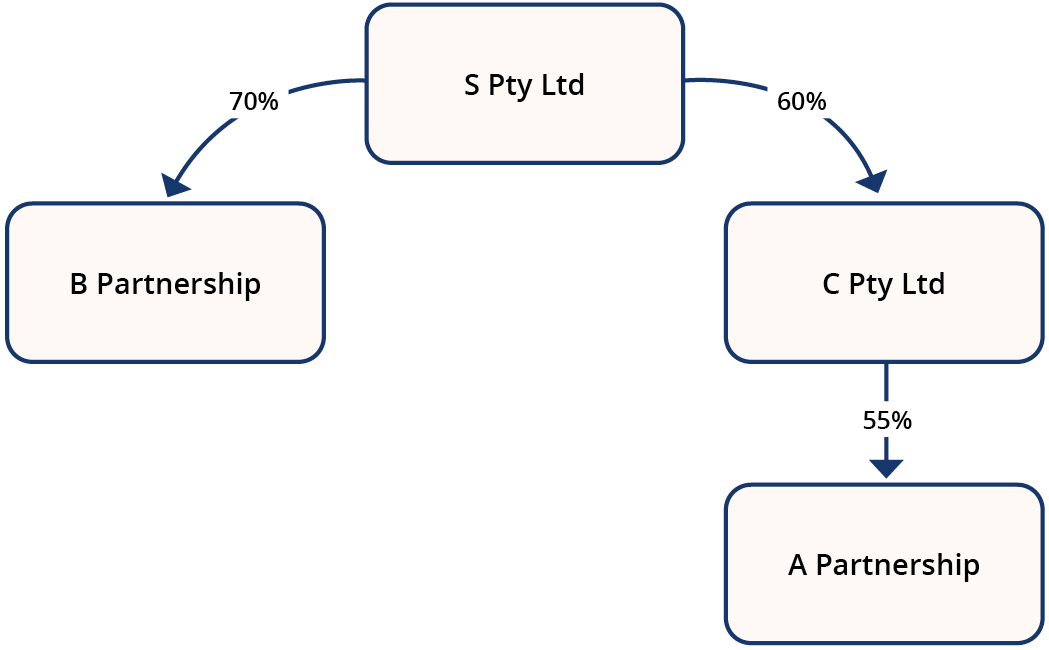

In this example:

- S Pty Ltd and C Pty Ltd are related bodies corporate

- C Pty Ltd has more than a 50% interest in A Partnership

- S Pty Ltd has more than a 50% interest in B Partnership.

As C Pty Ltd is a subsidiary of S Pty Ltd, S Pty Ltd is also deemed to have a controlling interest of A Partnership.

In this case, S Pty Ltd, C Pty Ltd, B Partnership and A Partnership are all grouped.