Endorsing transactions as a self assessor

Understand the rules for endorsing transactions and see examples of how to endorse the various transactions that you can self assess.

To acknowledge that you have assessed transfer duty on a transaction, you stamp (endorse) the document that evidences the transaction, record the relevant details and sign and date it when payment is made.

General rules for endorsing documents

You must not endorse a document unless your client has paid us directly or you have received the full amount of duty, and any unpaid tax interest (UTI) and penalty tax that applies.

If your client makes a direct payment to us, you must ensure the transaction no longer appears under Payment due in the Payments tab. You can also search for the transaction number in the Payment history tab to make sure it is paid before endorsing the document.

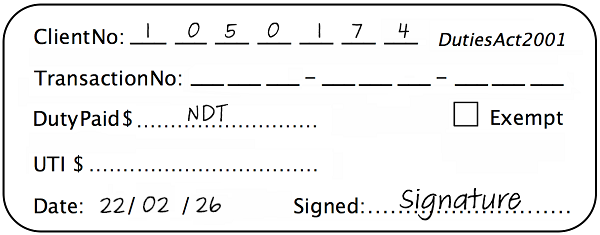

When endorsing documents, you must include your client number, transaction number, duty paid, UTI and penalty (if imposed). Endorsement is completed when the stamp is dated and signed. The stamp and all entries must be in black ink.

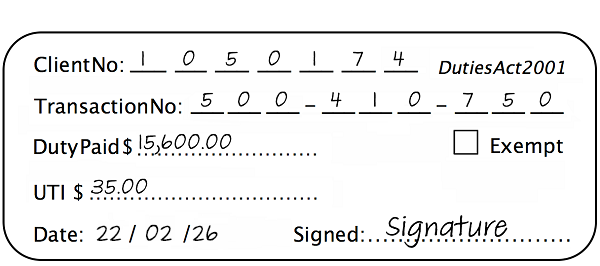

This is an example of a stamp on an ordinary contract or transfer transaction (including UTI) showing the fields that you must complete.

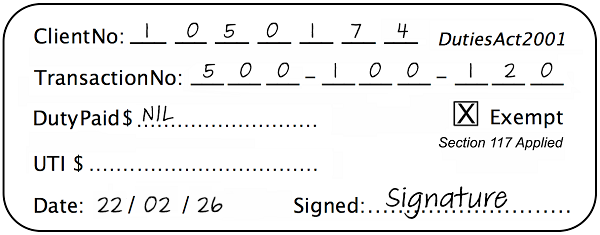

Exempt transactions

If you are applying an exemption to a contract, agreement, deed or transfer, the exempt box on the stamp must be checked. Record the duty paid as ‘nil’. Note the applicable exemption section of the Duties Act 2001 or Family Law Act 1975 (Cwlth).

Learn which exempt transactions must be self assessed.

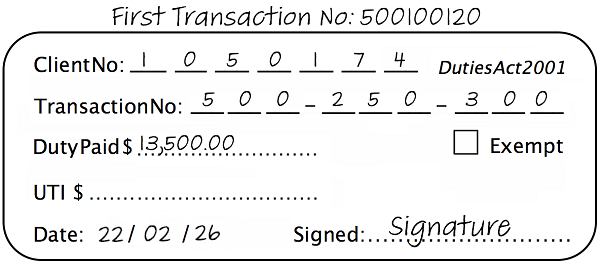

Transfers by direction

Transfers by direction involve a sale from party A to party B, then a further sale to party C. Usually, there will be a contract of sale between A and B and another between B and C, with one transfer from A to C. Both contracts are endorsed separately.

If you are the self assessor for the second contract only, you cannot endorse the transfer unless you have a copy of the first contract that shows the initial duty paid. You must keep a copy of the first contract on file.

When stamping the transfer, the transaction number for the first contract must be noted above the stamp.

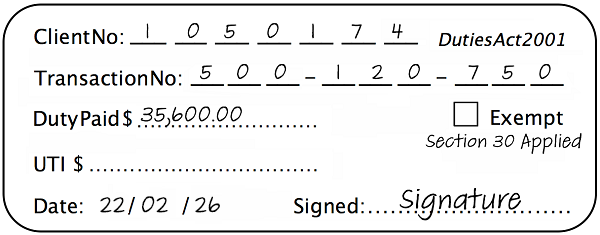

Aggregated transactions

When endorsing transactions aggregated under section 30 of the Duties Act, you must stamp each transaction separately and note ‘section 30 applied’.

Our section 30 aggregations toolkit explains how to assess multiple transactions that are part of the same arrangement.

Pursuant transfers (section 22)

You do not need to enter a pursuant transfer into QRO Online if you endorsed the primary instrument (contract of sale or agreement). The endorsement on the transfer must be identical to that on the contract or agreement to which the transfer relates (e.g. the same client number, transaction number, duty and UTI amounts).

If you are assessing a transfer that is pursuant to a primary document that has been endorsed by another self assessor or Queensland Revenue Office, the document must be entered into QRO Online. The endorsement on the transfer must be completed with the new details (e.g. client number and transaction number). The duty amount must be the same as the contract.

Non-dutiable transactions (NDTs)

Even though you do not need to enter NDTs into QRO Online or create a transaction number for them, you may still need to stamp the documents for other purposes (e.g. court proceedings). If you do stamp them, record your client number, enter ‘NDT’ as the duty paid, and date and sign the stamp. Record the transaction in your manual register.

Read the NDT toolkit for more information about assessing these types of transactions.

Replacement stamps

If you require new or replacement stamps, you need to get one made up at your own expense. You can get a self-inking stamp customised with your client number, so long as it’s in a similar format to the one we provided when you registered with us. That is, it must show:

- Client number

- Duties Act 2001

- Transaction number

- Duty paid amount

- Exempt tick box

- UTI paid amount

- Date endorsed

- Signature.

Also consider…

- Find out how to register as a self assessor.

- Get help with QRO Online.

- See the self assessor guidelines.