Non-dutiable transactions toolkit

See how to stamp and record non-dutiable transactions as a transfer duty self assessor.

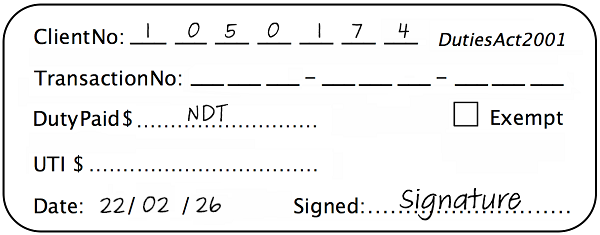

A non–dutiable transaction (NDT) is an agreement, deed, instrument or document that is not a dutiable transaction under the Duties Act 2001. NDTs are different to nil duty and exempt transactions, which are dutiable transactions and must be stamped.

The Duties Act doesn’t require NDTs to be stamped, but they may be stamped if needed for other purposes (e.g. court proceedings).

Stamping non-dutiable transactions

As a registered self assessor, you can stamp NDTs unless your registration indicates otherwise, in which case you’ll need to lodge the documents for stamping.

If you stamp an NDT, you must record it on a manual register. They don’t need to be entered into QRO Online and a transaction number is not required.

Types of NDT documents

You can stamp the following documents as an NDT:

- an instrument that a court requires to be stamped in order to be produced as evidence

- a non–dutiable instrument that is, or relates to, a deed of trust

- instruments a government agency requires to be stamped

- any other non–dutiable agreement (e.g. certain franchise agreements).

Procedure

Each NDT transaction must be recorded in your register and numbered (running consecutively) with the year of stamping noted at the end (e.g. the first NDT document for 2026 is numbered 1/26).

- Assign a number to the NDT.

- Enter the date the document was stamped.

- Enter the name of all parties to the transaction.

- Enter the description of the transaction.

- Enter the date the document was signed by the parties.

- Enter your reference.

Records you need to keep

You must keep the register, a copy of the document you stamped as an NDT and any other supporting information for 5 years. Any audits we conduct will include NDTs.

Find out more about your record–keeping obligations.

Offences and penalties

All offence and penalty provisions under the Duties Act and the Taxation Administration Act 2001 also apply to cases relating to NDTs. For more information, see the: