Groups formed through controlling interests for payroll tax

Learn who has controlling interest for different business types.

If a person has a controlling interest (more than 50%) in 2 or more businesses, those businesses are grouped. ‘Person’ includes an individual, a set of persons, a corporation, all bodies and associations (corporate, incorporated and unincorporated), and partnerships.

Who has controlling interest

The person who has controlling interest will depend on the type of business.

Different business types can be grouped if the same person or set of persons has a controlling interest.

The person who has controlling interest is the person who is entitled to exercise more than 50% of the voting power:

- at director meetings

- or

- attached to voting shares or a class of voting shares that the corporation has issued.

The person who has controlling interest is a person, or set of persons, who constitutes more than 50% of the management board, or controls the composition of the board.

The person who has controlling interest is the person who:

- owns more than 50% of the capital

- or

- is entitled to more than 50% of the profits.

The person who has controlling interest is the person who is a beneficiary of more than 50% of the value of the interest in the trust that carries on the business.

Under a discretionary trust, all beneficiaries are deemed to have a controlling interest.

The person who has controlling interest is either:

- the person who is the sole business owner (whether or not as trustee)

- or

- the group of people who are sole owners of a business as trustee.

Example

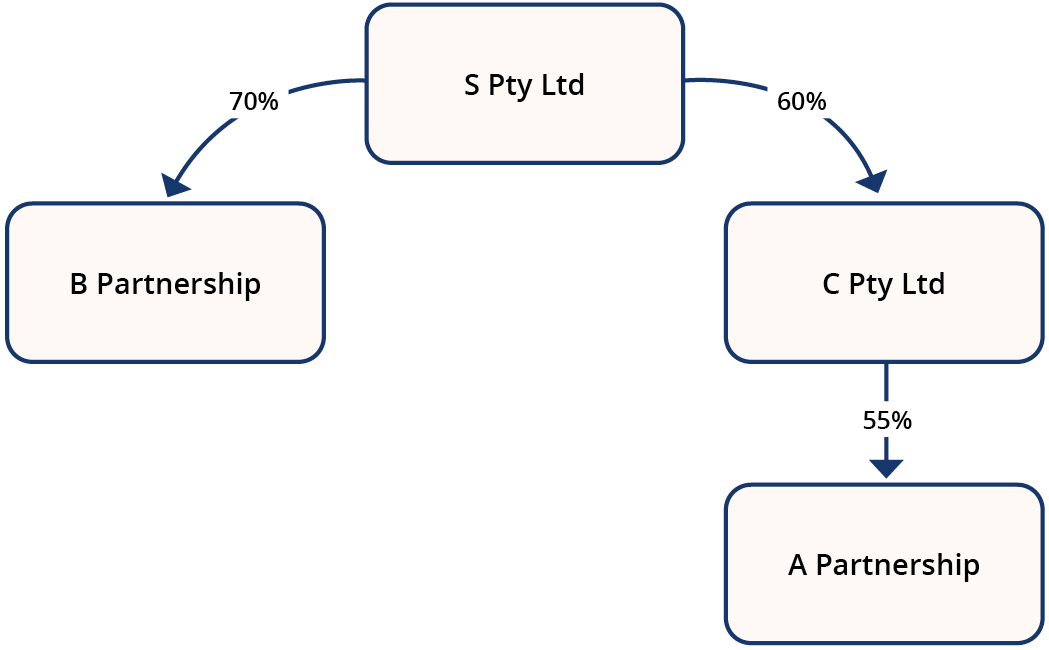

In this example:

- S Pty Ltd and C Pty Ltd are related bodies corporate

- C Pty Ltd has more than a 50% interest in A Partnership

- S Pty Ltd has more than a 50% interest in B Partnership.

As C Pty Ltd is a subsidiary of S Pty Ltd, S Pty Ltd is also deemed to have a controlling interest of A Partnership.

In this case, S Pty Ltd, C Pty Ltd, B Partnership and A Partnership are all grouped.