Deceased estates

22 June 2024

A public ruling, when issued, is the published view of the Commissioner of State Revenue (the Commissioner) on the particular topic to which it relates. It therefore replaces and overrides any existing private rulings, memoranda, manuals and advice provided by the Commissioner in respect of the issue(s) it addresses.

Where a change in legislation or case law (the law) affects the content of a public ruling, the change in the law overrides the public ruling—that is, the Commissioner will determine the tax liability or eligibility for a concession, grant or exemption, as the case may be, in accordance with the law.

What this ruling is about

- This public ruling explains when and how s.23 of the Land Tax Act 2010 (the Land Tax Act) will apply to land that forms part of a deceased person’s estate (‘deceased estate land’). For the avoidance of doubt, this public ruling applies to land tax liabilities that arise on or after midnight on 30 June 2025.

- It clarifies the Commissioner’s interpretation on the following topics:

- when s.23 applies to land that is held by an ‘estate administrator’ in that capacity when liability for land tax arises. This ruling explains when land will be held by an estate administrator and in particular:

- when the Commissioner considers administration of a deceased person’s estate has been completed with respect to land

and - when the Commissioner considers the estate administrator holds land as trustee of a trust created under the will.

- when the Commissioner considers administration of a deceased person’s estate has been completed with respect to land

- when deceased estate land will be taken to be owned by:

- the deceased person under s.23(4)

- a relevant beneficiary under s.23(3)

- the executor or administrator as trustee under s.20

- when the land tax home exemption will apply to deceased estate land.

- when s.23 applies to land that is held by an ‘estate administrator’ in that capacity when liability for land tax arises. This ruling explains when land will be held by an estate administrator and in particular:

Ruling and explanation

Section 23 of the Land Tax Act

- Land tax is imposed for each financial year on taxable land in Queensland as at midnight on 30 June immediately preceding the financial year, with the owner of the taxable land being liable to pay land tax.

- Section 10(1) of the Land Tax Act provides that the ‘owner’ of the land includes a person:

- entitled to the freehold estate, and who is in possession

- entitled to receive rents and profits from the land

- who is otherwise taken to be the owner of the land under the Land Tax Act.

- Section 10 is subject to s.23 of the Land Tax Act, which applies where land is owned by an ‘estate administrator’ in that capacity when a liability for land tax arises.1 An estate administrator is an executor or administrator of a deceased estate or a trustee of a trust created under a will.2 The land is owned by an estate administrator in that capacity where:

- the administration of the deceased estate has commenced but has not been completed

or - the administration of a deceased person’s estate has been completed (or administration has completed in respect of that specific land) and the estate administrator is a trustee of a trust for the land created under a will.

- the administration of the deceased estate has commenced but has not been completed

- Further detail on when an estate administrator will hold the land in that capacity are provided at paragraphs 13–29.

- Under s.23(4) of the Land Tax Act, where administration of the deceased estate has commenced but has not been completed, the deceased person is taken to be the owner until administration of the estate is complete and the estate administrator is taken not to be the owner of the land.

- Under s.23(5) of the Land Tax Act, where a deceased person is taken to be the owner and the land or part of the land was exempt land as at the last 30 June before the date of death, the land or part will continue to be exempt land as at the next 30 June after the date of death if, as at the next 30 June after the date of death:

- the land or part is not being used and has not been used since the date of death

or - the land or part is being used, and has been used since the date of death, only for a purpose for which it was being used on the last 30 June before the date of death.

- the land or part is not being used and has not been used since the date of death

- Where the administration of a deceased person’s estate has been completed or where the estate administrator has given assent in respect of the land (discussed at paragraphs 19–24) s.23(4) and (5) no longer apply as the administration of the estate is complete with respect to that land.

- From that time onwards, s.23 only applies to the land if the estate administrator holds the land under a trust created under a will and makes a request under s.23(2) in the approved form for the ‘relevant beneficiaries’ to be assessed as if they were the owners of the land. A relevant beneficiary is a beneficiary of a deceased estate or trust who has an interest in the land when a liability for land tax arises (discussed at paragraph 39).3 If a request is made under s.23(2) and the Commissioner is satisfied s.23 applies, each relevant beneficiary will be taken to be the owner of the land, in proportion to that beneficiary’s interest in the land.4

- However, once administration is complete or assent has been given and the land is not held under a trust created under a will, the land will no longer be held by an estate administrator and therefore s.23 will not apply. Instead, the deceased estate land will be assessed as being held on trust by the executor or administrator of a deceased estate under s.20(1).

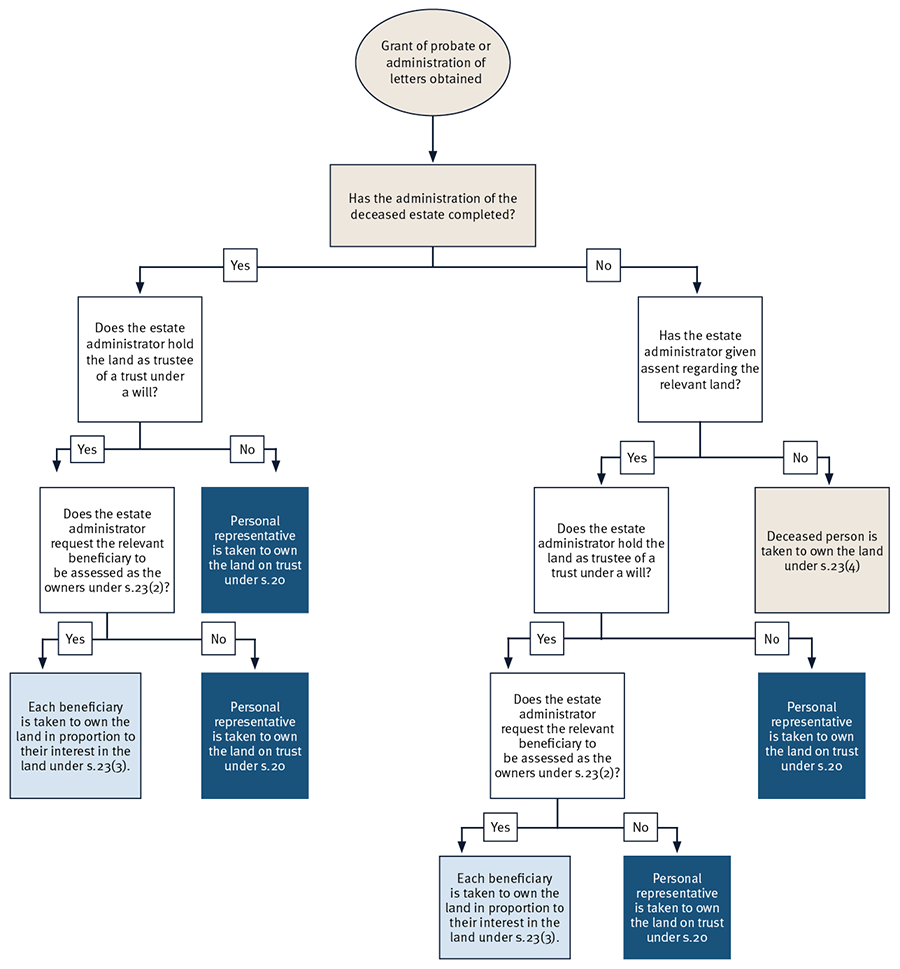

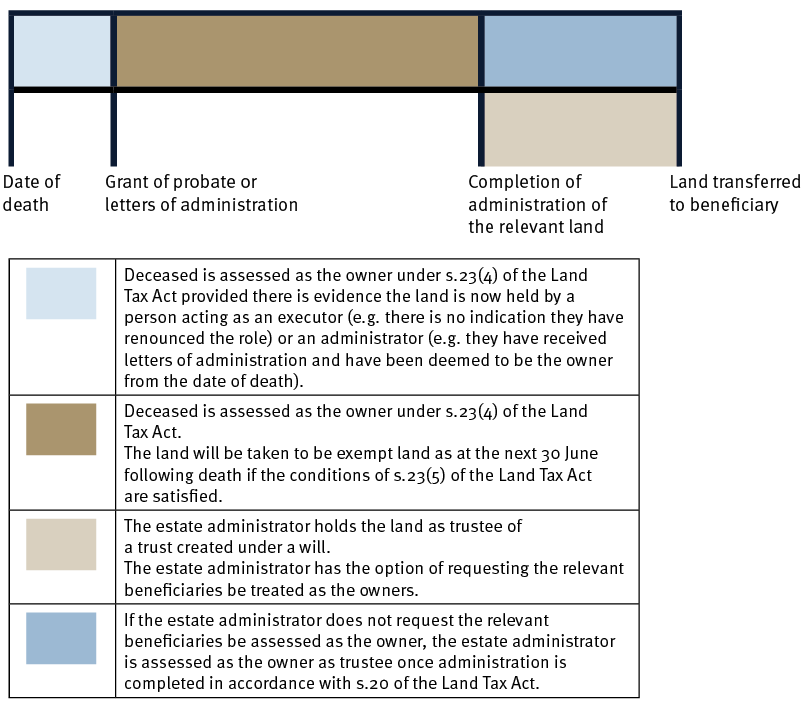

- The flow chart in Attachment 1 shows who will be taken to be the owner of the deceased estate land at any point in time.

When land will be held by an estate administrator

- Land will be owned by an estate administrator in the following circumstances.

- For an estate administrator who is an executor or administrator—if they are performing their functions regarding that land during administration. The functions of an executor or administrator in relation to land ends on the earlier of the following events:

- administration of the estate is completed (discussed at paragraphs 19–20)

or - assent has been given in relation to that land, bringing administration to an end for that land (discussed at paragraphs 21–24).

- administration of the estate is completed (discussed at paragraphs 19–20)

- For an estate administrator who is a trustee of a trust created under the will—if administration is complete and the trust under the will has commenced.

- For an estate administrator who is an executor or administrator—if they are performing their functions regarding that land during administration. The functions of an executor or administrator in relation to land ends on the earlier of the following events:

- The estate administrator need not be registered on title for s.23 to apply, provided the land has vested in the estate administrator in that capacity.

Process of administration

- When a person dies, their land vests in the executor or—if there is no executor willing and able to act—the Public Trustee.5 However, where they owned land as joint tenant the land will not form part of their estate and automatically transfers to the surviving joint tenant by the right of survivorship.

- Upon the grant of probate or letters of administration, the land then vests in the ‘personal representative’ to whom the grant is made.6 A personal representative refers to ‘the executor, original or by representation, or administrator of a deceased person’.7 This personal representative will therefore be an estate administrator during the process of administration, because they will be an executor or administrator of a deceased estate.

- This executor or administrator is responsible for the administration of the estate of the deceased. This involves paying all the remaining debts and liabilities and distributing the estate.

When administration commences

- A grant of probate or letters of administration will be a clear indication that administration has commenced. In the absence of a grant of probate or letters of administration, if a person requests the Registrar of Titles to register the deceased estate land in their name as personal representative, this will indicate administration has commenced.8

When administration ends

- Completion of the administration of an estate is a question of fact. Administration will be completed when all debts and liabilities have been paid, and the assets are ready for distribution.9

- The factors the Commissioner will consider when determining if administration of the estate has been completed include:

- Has an executor been appointed by the will?

- Has probate been applied for and granted by the Supreme Court of Queensland?

- Has an administrator been appointed by the Supreme Court of Queensland?

- Has the executor or administrator made payment or provision for funeral and testamentary expenses?

- Has the net income of the estate been applied to reduce debts of the estate?

- Has the executor or administrator made payment or provision for annuities and legacies?

- Has the residuary of the estate been ascertained, and is it available for distribution?

- Have final accounts of the estate been completed?

- Has any income been treated as that of the beneficiary’s for taxation purposes?

- Has the executor or administrator commenced holding any estate land in any other capacity (e.g. for a trust created under the will)?

Example 1

Arturo passes away on 1 June 2025.

In his will Arturo named Beryl as the executor of his estate. Arturo left his home Blackacre to his daughter Christine, $100,000 to his daughter Diane and the residue of his estate to various charities.

Immediately on Arturo’s passing, Blackacre vests in Beryl as Arturo’s executor.

Beryl promptly applies to the Supreme Court for probate of Arturo’s will. On 15 July 2025 probate is granted. Beryl applies for Arturo’s land to be registered in her name as Arturo’s representative.

Over the next 6 months Beryl administers Arturo’s estate. Some of her activities include:

- gathering in, maintaining and protecting the estate’s assets, including collecting outstanding debts owed to the estate

- obtaining valuations of the estate’s assets

- attending to payment of the estate’s debts, as well as any debts incurred in the course of administration

- keeping accounts in relation to the estate

- reasonably investing the proceeds of the estate for the benefit of beneficiaries.

On 1 December 2025, Beryl determines that no other assets of Arturo’s estate are needed to pay the estate’s liabilities and pays $100,000 to Diane. At this point Beryl is in position to transfer Arturo’s land to Christine in accordance with Arturo’s will, and administration is complete.

Partial administration

- An estate can be partly administered if the executorial duties of the executor or administrator have been completed in respect of some, but not all, of the assets.

- This will occur if the executor or administrator assents to property being distributed to a beneficiary when it is no longer required ‘to pay the debts, funeral expenses or general pecuniary legacies of the testator’.10

- Under s.49(1) of the Succession Act 1981, assent can be given by an executor or administrator with respect to real property. In Davidson v Cameron [2015] QSC 294, Jackson J explained that ‘whether or not an executor has assented is a question of fact and is to be inferred from the conduct of the executor’.11 Assent may be expressed verbally or in writing, or it may be inferred from the executor or administrator’s conduct.

Example 2

Theo passes away on 1 March 2025. Theo’s will states: ‘I give my apartment at 1/52 Bloggs Street to my brother Simon. I give bequeath and devise the residue of my estate to my sister absolutely.’

Quentin is Theo’s executor. From 1 June 2025 Quentin has:

- permitted Simon to reside in 1/52 Bloggs Street

- ascertained that the debts of Theo’s estate can easily be paid out of the amounts in Theo’s bank accounts

- orally told Simon he will transfer 1/52 Bloggs Street into his name by no later than 7 July 2025.

Quentin has provided assent in relation to 1/52 Bloggs Street.

- Once assent has been given in relation to land, that particular land is no longer under administration.

Time taken to administer estate

- At common law it is generally accepted an executor or administrator should administer a deceased estate within 12 months of the deceased’s death. Likewise, an executor or administrator is under a legislative obligation to distribute the estate ‘as soon as may be’.12 However, in practice, the time taken to complete administration will depend on what is reasonable in the circumstances (e.g. considering the size and complexity of the estate).

After administration—estate administrator as trustee of a trust created under a will

- Once administration is complete with respect to deceased estate land (i.e. administration ends or assent has been given in relation to land), the personal representative holds the land as trustee (as distinct from their capacity as executor or administrator) until it is transferred to the beneficiary.13

- However, for s.23 of the Land Tax Act to apply, after the administration is fully or partially complete the land must be held by an estate administrator as trustee of a trust created under a will.14 The fact a personal representative holds the land as trustee following the end of administration does not mean they own the land in their capacity as estate administrator. Whether a will creates a trust in respect of the land depends on the testator’s intentions as expressed through the will.

- A trust created under a will commences at the earlier of assent being given by the estate administrator in relation to the land or administration of the estate is completed.15 Whether a trust created under a will has come to an end will depend upon the facts of each case including the testator’s intentions and the powers given to the trustee.16

Example 3

Freya passes away on 1 July 2025. Freya’s will states:

‘I give, devise and bequeath the whole of my estate to my trustee upon trust to transfer to any children that shall survive me and attain the age of 21 years and, if more than one, as tenants in common in equal shares.’

At the time of her passing, Freya’s only child is her 19-year-old-son, Hugo. Her only land is her investment property Blackacre.

Under Freya’s will Gordon is named as the executor and trustee of her estate. Gordon completes the administration of Freya’s estate on 1 June 2026 and determines that Blackacre forms part of the residue of Freya’s estate.

At this point, Gordon commences holding Blackacre as trustee for Hugo under the trust established under the will; and Hugo is the relevant beneficiary with an interest in Blackacre.

Gordon gives the Commissioner a request, in the approved form, to assess Hugo as if he were the owner of Blackacre. The Commissioner approves this request with effect from 1 June 2026.

Summary

- In summary, an estate administrator will own land in that capacity in the following circumstances:

- from the date of death until the earlier of the following:

- they give assent in relation to that land, meaning administration is complete in respect of that land

- administration of the estate is complete.

or

- administration has ended in relation to the land (as outlined at subparagraphs (a)(i) and (a)(ii)) and the estate administrator now holds it as trustee of a trust created under the will.

- from the date of death until the earlier of the following:

When deceased estate land will be taken to be owned by the deceased person under s.23(4)

- Prior to the completion of the administration of the estate, as described at subparagraph 29(a), s.23(4) will apply to treat the deceased as owner of the land for the purpose of assessing a liability for land tax.

Example 4

Liam passed away on 1 April 2025.

Liam’s will specifies the entirety of his estate should pass to his brother, Ian. At the time of his death, the only land in Queensland that Liam held was his home Whiteacre.

Liam’s executor is still in the process of administering Liam’s estate on 30 June 2025. Consequently, for the 2025–26 land tax year, s.23 of the Land Tax Act would apply to deem Liam to be the owner of Whiteacre.

- However, following the completion of administration, s.23(4) will not apply to treat the deceased person as owner of the land. Instead, the owner will be taken to be either the relevant beneficiary or the trustee (as discussed in paragraphs 33–56).

- The diagram in Attachment 2 summarises who is the owner of deceased estate land at different points of administration.

When deceased estate land will be taken to be owned by a relevant beneficiary

- Following completion or partial completion of administration of a deceased estate as described at paragraph 29, the estate administrator may request under s.23(2) of the Land Tax Act for the relevant beneficiaries to be assessed as if they were the owners of the land.17 This will only be the case if:

- the beneficiary in question is a relevant beneficiary18

- the land is held by an estate administrator in that capacity when a liability for land tax arises.19

When a beneficiary is a relevant beneficiary

- Section 23(7) of the Land Tax Act defines a relevant beneficiary to mean a ‘beneficiary of the deceased estate or trust who has an interest in the land when a liability for land tax arises’.

- Schedule 4, Dictionary of the Land Tax Act also defines a ‘beneficiary’ of a trust to mean ‘a person entitled to a beneficial interest in land or income derived from land that is the subject of the trust’.

- Being the more specific definition, regard must be given to the definition of ‘relevant beneficiary’ in s.23(7) over the general definition of ‘beneficiary’ contained in Schedule 4. The definition of ‘relevant beneficiary’ in s.23(7) is narrower, in that it only applies to beneficiaries with an ‘interest in the land when a liability for land tax arises’.

- The term ‘interest in the land’ is not defined in the Land Tax Act, therefore it takes its ordinary meaning. It is well understood at common law that the term requires a proprietary interest in the land.20 A relevant beneficiary must therefore have a proprietary interest in the land.

- During the administration of an estate by an executor or administrator a beneficiary does not have proprietary interests in the estate’s assets.21 The beneficiary’s rights during administration are only for the due administration of the estate by the executor or administrator and while this occurs the legal and beneficial ownership of estate property remains solely with the executor or administrator.

- Consequently, a beneficiary will not have a proprietary interest in land until the earlier of the following:

- when an executor or administrator assents to the land being distributed to a beneficiary

or - when administration of the estate is complete.22

- when an executor or administrator assents to the land being distributed to a beneficiary

Relevant beneficiaries—identifying the land and beneficiaries

- To consider a request for a relevant beneficiary to be assessed as the owner under s.23(2) of the Land Tax Act, the land and relevant beneficiaries must be clearly identifiable.

- Where the land and/or relevant beneficiary is not specifically identified in a will, other evidence must be provided to establish the land was part of the deceased estate and the beneficiary is a relevant beneficiary of the estate.

Example 5

Evelyn passes away on 1 July 2025. Her will states: ‘I leave my apartment in Brisbane to my trustee to hold for my sister Taylor.’

At the time of her death Evelyn’s only sister is Taylor. Evelyn owned two properties: her apartment Blueacre (located in Brisbane) and her house Goldacre (located on the Gold Coast). Sebastian is Evelyn’s executor and trustee. He completes administration on 1 December 2025, and commences holding Blueacre as trustee.

Evelyn’s trustee applies under s.23(2) for Taylor to be taken to be the owner of Blueacre.

From the terms of the will and the available facts, the Commissioner is satisfied Taylor has an interest in Blueacre. The Commissioner would consider Taylor to be a relevant beneficiary in respect of Blueacre from 1 December 2025 onwards.

Example 6

Ali passes away on 1 July 2025. Ali’s will states: ‘I leave the rest and residue of my estate to my trustee to convey to such children as may survive me to hold as tenants in common in equal shares.’

This wording indicates that Ali intended for the residue of his estate to be held on trust under his will.

Ali is survived by his children, Chris and Dana. At the time of his death Ali owned two parcels of land in Queensland: Greyacre and Redacre.

Alice is Ali’s executor and trustee. Alice completes administration on 1 December 2025. In the course of administration Alice was obliged to sell Greyacre to pay the estate’s liabilities. In contrast, Alice commences holding Redacre as trustee of a trust created under a will from 1 December 2025 because it forms part of the residue of Ali’s estate.

Alice applies under s.23(2) for Chris and Dana to be taken to be the owners of Redacre.

The Commissioner would consider Chris and Dana to be relevant beneficiaries in respect of Redacre from 1 December 2025.

- The trustee of a trust created under a will may have the power to acquire land under the terms of the trust.23 Where land has been acquired in accordance with the powers conferred on the trustee and the terms of the trust, a request under s.23(2) of the Land Tax Act that a relevant beneficiary be assessed as the owner may be made if the land is held by the trustee of the trust created under the will.

Example 7

Tim passes away on 1 July 2025. Tim’s will states: ‘I leave the rest and residue of my estate to my trustee to hold for my daughter Anita.’

Tim’s will further states: ‘My trustee shall have absolute power and discretion to apply the income or capital of my estate to invest in any investment authorised by law.’

At the time of his death Tim did not own any land. He is survived by his daughter Anita.

Nadia is Tim’s executor and trustee. She completes administration on 1 December 2025. On 1 January 2026 Nadia decides to invest part of Tim’s estate to acquire a parcel of land in Toowoomba (Southacre) to hold on trust for Anita.

On 1 March 2026 Nadia applies under s.23(2) for Anita to be taken to be the owner of Southacre.

The Commissioner would consider Anita to be a relevant beneficiary in respect of Southacre from 1 January 2026.

Relevant beneficiaries and contingent interests

- In some cases, a beneficiary will have a contingent interest in deceased estate land, meaning their interest is not yet vested. For example, the beneficiary has a future contingent interest in the land where land is devised to a beneficiary upon attaining a stated age and the age has not yet been reached:

- on completion of administration of the estate and it is held in a trust created under the will

or - when there has been assent with respect to the land and it is held in a trust created under the will.

- on completion of administration of the estate and it is held in a trust created under the will

- Such a contingent interest would be an interest in land for the purposes of s.23(7) of the Land Tax Act, and a beneficiary who has this interest as at 30 June would be a relevant beneficiary. Consequently, an estate administrator may make a request under s.23(2) of the Land Tax Act to treat the relevant beneficiary as the owner.

Example 8

Juanita passes away on 1 July 2025. Juanita’s will states: ‘I leave my home Westacre to my executor and trustee to transfer to my nephew Kyle if he attains the age of 30.’

Kyle is 19 years old at the time Juanita passes away.

Linda is Juanita’s executor and trustee. She completes administration on 1 December 2025.

On 1 March 2026 Linda applies under s.23(3) for Kyle to be taken to be the owner of Westacre.

The Commissioner would consider Kyle to be a relevant beneficiary.

Life estates and reversions or remainders

- A life estate holder may be an owner as defined in s.10(1)(a) of the Land Tax Act if they are jointly or severally entitled to a freehold estate and are in possession. Possession for the purpose of determining ownership under the Land Tax Act is taken to mean entitlement to the control, use and occupancy of the land including the rents and profits from the land. A life estate holder will not be in possession until administration is complete.

- Also, s.14 of the Land Tax Act provides where there is a person entitled to a life estate in possession in land, a person entitled to the fee simple interest in the reversion or remainder is taken not to be the owner of land.

- For the avoidance of doubt, a beneficiary of a deceased estate who is given a life estate in possession may also be a relevant beneficiary, provided administration is complete or assent has been given in respect of the land.

Example 9

Paul passes away on 1 July 2025. Paul’s will states:

‘My executors must hold my home on trust for my husband, Dan, to use and occupy for as long as he may live, and thereafter to such of my children that shall survive him; and, if more than one, as joint tenants.’

At the time of his passing, Paul’s home was the only land he owned in Queensland. On 1 December 2025 Paul’s executor assents to this land being held by Dan.

As at 1 December 2025 Dan has a life estate in the home. Paul’s children are entitled to a remainder interest.

At midnight on 30 June 2026 Dan would be assessed as the owner.

- In contrast, a person who is only entitled to the reversion or remainder in deceased estate land cannot be treated as the owner under s.23(2) as it would be contrary to s.14 of the Land Tax Act. Section 14 applies where a person is entitled to a life estate in possession in land. In that circumstance, the holder of a life estate is taken to be an owner of the land to the exclusion of any person entitled to an interest in reversion or remainder.

Example 10

Same facts as Example 9. Paul’s children cannot be assessed as the owners of land under s.23(2).

Right to reside

- A beneficiary who has a mere right to reside in deceased estate land, as opposed to a life estate, will not be a relevant beneficiary under s.23(7) of the Land Tax Act. This is because a right to reside does not confer a proprietary interest or estate in land.24

- Whether a beneficiary has a mere right to reside, or a life estate will be determined on all relevant facts and circumstances on a case-by-case basis.

Example 11

Jason passes away. At the time of his death Jason owned Sandacre. He intended to give his cousin Robert a right to reside at Sandacre.

Jason’s will states: ‘I give Sandacre to my trustee on trust to permit my cousin, Robert, to reside in Sandacre as his home for as long as he wishes free of rent.’

In this circumstance, the Commissioner would be likely to consider that Robert has a right to reside in Sandacre, as opposed to a life estate.

Where a beneficiary is a minor

- A relevant beneficiary may be a minor when a liability for land tax arises. Nonetheless, an estate administrator may request under s.23(2) for the minor to be taken to be the owner and the Commissioner may be satisfied the minor is the owner.

Where a beneficiary is only entitled to income

- A beneficiary who is only entitled to income derived from the land is not entitled to an interest in the land. Such a beneficiary therefore cannot be a relevant beneficiary under s.23(7) of the Land Tax Act.

Example 12

Harry is the owner of Blackacre. His will leaves the income from Blackacre to Ieuan and Johanna, and all the capital of the estate to Karen. For s.23(7), only Karen can be considered a relevant beneficiary in respect of Blackacre.

What if land is not held by an estate administrator?

- Paragraph 13 sets out when land will be taken to be held by an estate administrator in that capacity. If the land is not held by an estate administrator in that capacity, s.23(2) and (3) of the Land Tax Act cannot apply, even if the beneficiary is a relevant beneficiary.

Example 13

Jayden passes away. His deceased estate includes his home at the Gold Coast. Karen is the administrator of his estate.

Jayden’s will states: ‘I leave my home to my wife, Jolene, absolutely.’

On completion of administration, Jolene gains a proprietary interest in Jayden’s land; and Karen begins holding the land as trustee.

However, Karen does not hold the land as the trustee of a trust under the will. Nor does she hold it as executor or administrator because she has completed her role as administrator.

Consequently, following the end of administration the deceased estate land is no longer held by Karen as an estate administrator, and therefore s.23 of the Land Tax Act cannot apply to the deceased estate land.

Instead, Karen would be assessed as the owner of Jayden’s land as trustee under s.20 of the Land Tax Act until the land is transferred to Jolene (as discussed at paragraphs 54–56).

When deceased estate land will be taken to be owned by the executor or administrator as trustee under s.20

- As explained at subparagraph 13(a), when administration ends the executor or administrator ceases to perform their functions and therefore ceases to hold the land as executor or administrator. Instead, they commence holding the land as trustee.

- Where the executor or administrator ceases to perform their functions as an executor or administrator—and the land is not held in a trust created under a will—the estate administrator ceases to hold the land in their capacity as an estate administrator and s.23 of the Land Tax Act does not apply.

- Consequently, s.20 of the Land Tax Act will apply to assess the executor or administrator as a trustee of a trust.

Example 14

Wilbur passed away on 1 July 2025. Wilbur’s will states: ‘I devise my land at Greenacre to my daughter Cordelia absolutely.’

Under Wilbur’s will, Sam is named as the executor of his estate.

Sam completes the administration of Wilbur’s estate on 1 June 2026. At this point Cordelia becomes the beneficial owner of Greenacre and Sam commences holding Greenacre as trustee for Cordelia until the land can be formally registered in her name.

However, as the land was bequeathed absolutely to Cordelia with no indication that it was to be held on trust, there is no trust created under the will.

Instead, as at midnight on 30 June 2026, if Sam continues to hold Greenacre, he does so generally as a trustee, not under a trust created under the will. Consequently, s.23 of the Land Tax Act will not apply and Sam will be taken to be the owner of Greenacre as trustee under s.20 of the Land Tax Act.

When the land tax home exemption will apply to deceased estate land

- A land tax home exemption is available under Part 6, Division 1 of the Land Tax Act for land or part of land that is used as a home. Section 35 of the Land Tax Act explains the operation of the home exemption provisions. If the home exemption applies to deceased estate land, the land is exempt land and the owner will not have to pay land tax on it.25 The circumstances in which the home exemption will apply will differ depending on whether the land or part of land that is used as a home is owned by the deceased person (s.23(4)), the relevant beneficiaries (s.23(3)) or the trustee (s.20).

Where the deceased person is taken to be the owner (s.23(4))

- Where the deceased person is taken to be the owner under s.23(4), s.23(5) states that land or part of that land is exempt land for the purpose of assessing a liability for land tax arising on the next 30 June after the date of death if:

- as at the last 30 June before the date of death, the land or part was exempt land

and - as at the next 30 June after the date of death

- the land or part is not being used and has not been used since the date of death

or - the land or part is being used, and has been used since the date of death, only for a purpose for which it was being used on the last 30 June before the date of death.

- the land or part is not being used and has not been used since the date of death

- as at the last 30 June before the date of death, the land or part was exempt land

- On the second 30 June following the date of death, s.23(5) will cease to apply, and the land or part of land will be assessed as taxable land held by the deceased person.

Example 15

Bob passed away on 17 August 2025.

Bob was still living in the home for which he had been receiving the benefit of the home exemption at that time.

The administrator of Bob’s estate submits an application for a home exemption to the home from 30 June 2026.

If approved by the Commissioner, the home exemption will continue until 30 June 2026, unless the property is rented, transferred or otherwise used.

Where relevant beneficiaries are treated as the owner (s.23(3))

- Where s.23(2) and (3) apply so the relevant beneficiaries are taken to be the owners of land26, ss.35(2)(a) and 41(1)(b)(i) of the Land Tax Act may apply to exempt the land if used as the home of that owner.

- In such cases, the relevant beneficiary’s—or each relevant beneficiary’s (if there is more than one relevant beneficiary)—entitlement to the home exemption with respect to their interest in the land will depend on their individual circumstances and whether the land has been used as their home in accordance with s.36 of the Land Tax Act.27 Public Ruling LTA000.1 The land tax exemption for a home outlines the factors the Commissioner uses in determining whether the land is used as a home.

Example 16

On completion of administration of Anika’s estate, the executor of her will lodges a request under s.23(2) of the Land Tax Act for Bernard to be treated as the owner.

The Commissioner is satisfied Bernard is a relevant beneficiary and takes him to be the owner of the land under s.23(3). His entitlement to the home exemption in relation to his interest in the land will depend on his individual circumstances and whether the land has been used as his home in accordance with ss.35(2)(a) and 36 of the Land Tax Act.

Where the administrator or executor holds the land as trustee (s.20)

- Where s.23 does not apply and land is held on trust by the executor or administrator (e.g. when administration or a trust created under the will has ended) the trustee is assessed as owner of the land.

- Under ss.35(2)(b) and 41(1)(b)(ii), for the home exemption to apply, the land must be used as the home of all beneficiaries of the trust. Public Ruling LTA041.1 Land tax home exemption—trustees provides further guidance on the operation of the exemption in relation to a trustee of a trust.

Example 17

Hubert passes away. His will leaves all his land to Charlotte and Denise in equal shares.

Hubert’s executor, Ellis, completes administration of his estate and lodges a request under s.23(2) of the Land Tax Act for Charlotte and Denise to be treated as the owners.

The land is not held pursuant to a trust created under the will.

As Ellis does not own the land in the capacity of estate administrator, s.23 has no application and Charlotte and Denise cannot be relevant beneficiaries. Ellis will be assessed as the owner of the land in his capacity as trustee because he is simply holding the land as trustee before title can be transferred to Charlotte and Denise.

Section 20 of the Land Tax Act will apply to assess land held by Ellis separately to any other taxable land he owns. A home exemption will be available if the land is used as the home of both Charlotte and Denise in accordance with ss.35(2)(b) and 36 of the Land Tax Act.

Date of effect

- This public ruling takes effect from 30 June 2025.

Simon McKee

Commissioner of State Revenue

Date of issue: 22 June 2024

References

| Public Ruling | Issued | Dates of effect | |

|---|---|---|---|

| From | To | ||

| LTA023.1.2 | 22 June 2024 | 30 June 2025 | Post–30 June 2025 |

| LTA023.1.1 | 15 March 2024 | 15 March 2024 | 21 June 2024 |

Attachment 1—deceased estate land—who is taken to be the owner

Attachment 2—deceased estate land—who the owner is before, during and after administration

Footnotes

- Section 23(1) of the Land Tax Act

- Section 23(7) of the Land Tax Act

- Section 23(8) of the Land Tax Act

- Section 23(3) of the Land Tax Act

- Section 45(1) of the Succession Act 1981 (Succession Act)

- Section 45(2) of the Succession Act. Probate is granted where there is a valid will and an executor named in the will is applying. Letters of administration are granted where there is a will and a person other than the executor named in the will is applying, or where there is no valid will.

- Section 5 of the Succession Act

- See s.111 of the Land Title Act 1994

- To the beneficiaries under the will with immediate gifts; to the trustee of the will where gifts are to be held on trust; or to the next of kin on intestacy

- Davidson v Cameron [2015] QSC 294 at [11], citing Kemp v Commissioner of Inland Revenue [1905] 1 KB 581 at 585

- At [13]

- Section 52(1)(d) of the Succession Act

- Re Donkin (deceased) [1966] Qd R 96 at 117

- Section 23(7) of the Land Tax Act

- Commissioner of State Duties (Qld) v Livingston (1964) 112 CLR 12 at 18

- Trustee for Estate of Carmelo Ponticello deceased v Commissioner of Land Tax [1997] QLC 171

- Form LT24—Deceased estate—request to assess beneficiaries as the owner

- Section 23(2) and 23(7) of the Land Tax Act

- Section 23(1) of the Land Tax Act

- Sojitz Coal Resources Pty Ltd v Commissioner of State Revenue [2015] QSC 9

- Commissioner of Stamp Duties (Qld) v Livingston (1964) 112 CLR 12 at 18, Official Receiver in Bankruptcy v Schultz (1990) 170 CLR 306 at 312, Barns v Barns (2003) 214 CLR 169 at [50] and Re Constantinou (deceased) [2012] QSC 332 at [33]

- Commissioner of Stamp Duties (Qld) v Livingston (1964) 112 CLR 12

- A trustee may also have the power to invest under s.21 of the Trusts Act 1973.

- Hurley v Hurley (1947) 75 CLR 289 at 290-291

- Section 35(2) of the Land Tax Act

- Where completion of the estate is complete or there has been assent, and there is subsequent trust created under the will.

- Where s.23(2) and (3) do not apply, s.23(4)–(6) apply to take the deceased person to be the owner and the home exemption may continue to apply in certain circumstances for a limited period, even where no beneficiaries are residing in the property.