Payroll tax deductions

Find out about what deductions are available and if you can claim one.

A deduction may be available if your total annual Australian taxable wages are less than $10.4 million.

For annual Australian taxable wages over the $1.3 million threshold, the deduction reduces by $1 for every $7 of taxable wages over this amount. The deduction reduces to zero when your Australian taxable wages reach $10.4 million.

For example, the maximum monthly deduction is $108,333 and is reduced by $1 for every $7 of monthly wages over this amount. The deduction reduces to zero when monthly wages reach $866,666.

If you are part of a group, only the designated group employer (DGE) can claim a deduction. The deduction is available if the group’s total Australian wages are less than $10.4 million. If you are the DGE and your group’s deduction is greater than your wages, you can nominate a group member (who is registered for payroll tax in Queensland) to receive your excess deduction. If you don’t nominate anyone, we’ll decide which members of the group receive this amount. The excess deduction cannot be split across group members and will be applied in full to your first nominated group member. If there is any deduction remaining after the group member’s liability is reduced to nil, it will then be applied to the next group member until the deduction has been applied in full.

Changes to the amount of wages you pay throughout the year will affect the deduction you can claim in each return period. If you do not employ for the full financial year, the deduction will be adjusted proportionally.

Wage range for deduction

The current monthly and yearly wage ranges for the deduction have been in effect since 1 January 2023.

The ranges are:

- monthly taxable wages from $108,333 to $866,666

- yearly taxable wages from $1,300,000 to $10,400,000.

The wage ranges for the deduction were:

- monthly taxable wages from $108,333 to $541,666

- yearly taxable wages from $1,300,000 to $6,500,000.

Types of deductions

The type of deduction you can claim will depend on your circumstances and how your business operates.

- The deduction should be calculated for every periodic return.

- You can claim the deduction if you are not in a group and only pay wages in Queensland.

- When you lodge your periodic return, QRO Online will calculate the deduction amount.

- The deduction should be calculated at the beginning of the financial year.

- You can claim the deduction if you are not in a group and pay (or will pay) interstate wages or you are the designated group employer for a group.

- To claim the deduction, enter the deduction amount in the ‘Fixed periodic deduction’ field when you lodge your periodic return.

You can use our fixed periodic deduction calculator to determine this amount.

- The deduction should be calculated at the end of the financial year.

- You can claim the deduction if you are not in a group or are the designated group employer for a group.

- When you lodge your annual return, QRO Online will calculate the deduction amount.

Actual periodic deductions

Use our periodic liability calculator or the estimator in QRO Online to calculate your payroll tax and mental health levy liability (if applicable) for each return period.

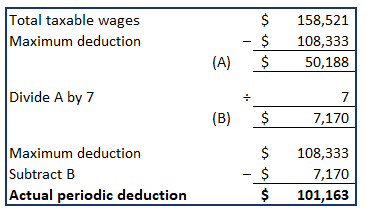

In this example, the monthly Queensland taxable wages are $158,521.

This is how your deduction is calculated if you pay payroll tax monthly and your taxable wages for the month are less than $866,666.

The deduction is reduced by $1 for every $7 of Australian taxable wages above the $1.3 million threshold.

Fixed periodic deductions

- are not in a group but pay interstate wages

- or

- you are a designated group employer.

The fixed periodic deduction estimator is calculated using the:

- estimated Queensland and interstate taxable wages for the full financial year, for non-grouped employers

- estimated total group’s Queensland and interstate taxable wages for the full financial year, for designated group employers.

Use our fixed periodic deduction calculator or the estimator in QRO Online to work out the deduction.

In most cases, you only need to calculate your fixed periodic deduction at the start of each financial year (1 July) and enter the same amount in the ‘Fixed periodic deduction’ field when completing each periodic return.

You should keep a record of your fixed periodic deduction on file.

Changes to your fixed periodic deduction

If any of the events in this table happen, you will need to:

- recalculate your fixed periodic deduction

- and

- deduct the new amount from your wages for the remaining periodic returns for the year.

| Event | When to recalculate the deduction |

|---|---|

| You start paying interstate wages | First day of the return period |

| You paid wages that increased or decreased by more than 30% of the wages you originally estimated | Last day of a return period |

| Your deduction is revoked or lapses | The day you are notified or the previous notification runs out |

| Your lodgement frequency is changed | First day of new return period |

This example uses these estimated wages for the financial year:

- Queensland taxable wages $387,524

- Australian taxable wages $1,500,000.

The deduction is reduced by $1 for every $7 of Australian taxable wages above the $1.3 million threshold.

Annual deductions

If you are not in a group, calculate your annual deduction from your Queensland taxable wages using your total Australian taxable wages for that year.

If you are the designated group employer, calculate your annual deduction using the total Australian taxable wages of the group.

In this example, a non-grouped employer paid these wages for the financial year:

- Queensland taxable wages $1,356,789

- Australian taxable wages $1,789,776.

The deduction is reduced by $1 for every $7 of Australian taxable wages above the $1.3 million threshold.

Also consider…

- Read more about what type of return you need to lodge and when it is due.

- Learn about the common payroll tax exemptions.

- Find out about calculating deductions in sections 17, 23, 29, 33, 37 or 41 of the Payroll Tax Act 1971.