Relevant contracts—medical centres

03 March 2025

A public ruling, when issued, is the published view of the Commissioner of State Revenue (the Commissioner) on the particular topic to which it relates. It therefore replaces and overrides any existing private rulings, memoranda, manuals and advice provided by the Commissioner in respect of the issue(s) it addresses.

Where a change in legislation or case law (the law) affects the content of a public ruling, the change in the law overrides the public ruling—that is, the Commissioner will determine the tax liability or eligibility for a concession, grant or exemption, as the case may be, in accordance with the law.

What this ruling is about

- The purpose of this public ruling is to explain the application of the relevant contract provisions in the Payroll Tax Act 1971 (Qld) (the Act) to an entity that conducts a medical centre business (referred to as a ‘medical centre’), including dental clinics, physiotherapy practices, radiology centres and similar healthcare providers who engage medical, dental and other health practitioners or their entities (‘practitioners’) to provide patients with access to the services of practitioners.

- References in this public ruling to section numbers are references to provisions of the Act unless otherwise specified.

- This public ruling addresses the following issues:

| Issue | Paragraphs |

|---|---|

| Liability for payroll tax | 5–13 |

| Application of the relevant contract provisions to a medical centre | 14–18 |

| Separate businesses conducted by medical centres and practitioners | 19–20 |

| When is a contract a relevant contract? | 21–24 |

| Recent decisions | 25–30 |

| Engaging a practitioner from a practitioner’s entity | 31 |

Exemptions from the relevant contract provisions under s.13B(2):

|

32–42 |

| Who is the employer under s.13C? | 43–46 |

| Who is the employee under s.13D? | 47–49 |

| Deemed wages—common payment arrangements | 50 |

| Which payments are deemed wages under s.13E? | 51–55 |

| Third party payments taken to be wages under s.51 | 56–70 |

| Other matters | 71–80 |

| Records must be kept for at least 5 years | 81–82 |

Ruling and explanation

- This public ruling explains the application of the relevant contract provisions in Division 1A of Part 2 of the Act to a contract between a medical centre and a practitioner who is engaged to serve patients for or on behalf of the medical centre. It should be read together with the Commissioner’s other public rulings that explain the general application of the relevant contract provisions.

Liability for payroll tax

- Part 2 of the Act imposes liability for payroll tax. Whether there is a payroll tax liability will depend on the particular facts and circumstances of each matter. Generally, payroll tax is payable by employers on all taxable wages paid to a common law employee (Part 2 Division 1 of the Act). Where there is no common law employer–employee relationship, liability for payroll tax will arise if it is established amounts are paid under a relevant contract to a contractor (Part 2 Division 1A of the Act). Thirdly, where there is no common law employer–employee relationship or no relevant contract involving a contractor, liability may still arise if it is established amounts are paid under a ‘employment agency contract’ to a service provider (Part 2 Division 1B of the Act).

- If liability for payroll tax arises due to the operation of Division 1A or 1B, there are deeming provisions that apply to bring independent contractors and employment agents within the operation of Division 1.1

- Under Division 1, employers are liable to payroll tax on wages paid by common law employers to employees. The definition of ‘wages’ includes amounts paid ‘to an employee as an employee’. The term ‘employee’ is not defined in the Act, therefore common law employment tests apply to determine whether a worker is an employee. For further details refer to Public Ruling PTA038 Determining whether a worker is an employee.

- In many cases, the common law employer tests can be difficult for businesses to apply to accurately assess their liability when they engage contractors. Further, it was recognised the increasing use of contractor arrangements to convert common law employees to contractor arrangements provided increased opportunities for revenue avoidance. As a result, the Act has, since 2008, included ‘contractor’ provisions (Part 2 Division 1A), which are substantially aligned with the ‘contractor’ provisions of New South Wales and Victoria.2

- Consequently, the definition of ‘wages’ also includes an amount taken to be wages under another provision of the Act.3 Therefore, in addition to wages paid to a common law employee under Division 1, Division 1A makes payments to contractors providing services under a relevant contract liable to payroll tax unless one or more exemptions in Division 1A apply. The Division 1A exemptions are designed to exclude payments to genuine independent contractors.

- This has the result that if the contract is a relevant contract, the principal is deemed to be an employer, the contractor is deemed to be an employee and payments made under the contract for the performance of work are deemed to be wages unless an exemption applies.

- Wages, whether paid or payable under Division 1 or 1A, are exempt from payroll tax and the mental health levy if paid or payable by a medical practice to a general practitioner.4

- A ‘medical practice’ is defined to mean an entity carrying on a business at which services of the kind ordinarily provided by a medical practitioner who is registered in the specialty of general practice are provided, other than a hospital. The definition of ‘general practitioner’ is limited to those that provide services of the kind ordinarily provided by a medical practitioner who is registered in the specialty of general practice.5

- Because the exemption only applies to wages paid or payable by a medical practice (as defined) to a general practitioner (as defined), it does not extend to payments made by other types of medical centre businesses (e.g. a dental clinic or physiotherapy practice). Nor does it extend to payments to other types of health practitioners (e.g. a dentist or physiotherapist).

Application of relevant contract provisions to a medical centre

- A contract between an entity that conducts a medical centre and a practitioner is a relevant contract under s.13B if all the following apply:

- the practitioner carries on a business or practice of providing medical-related services to patients

- in the course of conducting its business, the medical centre

- provides members of the public with access to medical-related services

- engages a practitioner to supply services to the medical centre by serving patients on its behalf

- an exemption under s.13B(2) does not apply.

- Further to (b) above, factors to consider in determining whether a medical centre business is being conducted for the purpose of this ruling are provided in Attachment 1.

- Under s.13A, ‘contract’ includes an agreement, arrangement or undertaking, whether formal or informal and whether express or implied.

- If a medical centre engages a practitioner to practise from its medical centre, or holds out to the public that it provides patients with access to medical services of a practitioner, it is likely the relevant contract provisions will apply to the contract with the practitioner unless an exception (i.e. exemption) applies.

- A practitioner engaged by a medical centre to serve patients for or on behalf of the medical centre under a relevant contract supplies services to the medical centre as well as to patients. (See The Optical Superstore Pty Ltd v Commissioner of State Revenue [2018] VCAT 169 at [82]-[85] (The Optical Superstore case) and Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue [2023] NSWCA40 at [41])

Separate businesses conducted by medical centres and practitioners

- Under a relevant contract, the medical centre and each practitioner engaged by the medical centre conducts separate but related businesses (see, for example, Commissioner of Taxation v Healius Ltd [2020] FCAFC 173 at 32). The medical centre provides patients with access to medical services provided by practitioners. The medical centre also provides services and facilities to the practitioners and patients by attracting patients, advertising the services offered by practitioners, managing the services provided to patients including arranging appointments and billing patients either directly or by bulk billing Medicare, and maintaining patient records.

- Practitioners have professional responsibility for the medical care and advice they provide to patients. The services provided by practitioners are provided in the course of their own business. However, the medical centre has operational or administrative control over the practitioners if it is able to influence matters such as who practises at the centre, the hours and days when they practise, and the space within the centre where that occurs. Additional factors that may indicate operational or administrative control over a practitioner by the medical centre are provided in Attachment 2. These factors are not exhaustive, and a medical centre may have operational or administrative control even if one of the factors in Attachment 2 is not present.

When is a contract a relevant contract?

- A contract is a relevant contract under s.13B(1) if it provides for the supply of services ‘in relation to the performance of work’ by one party for or on behalf of the other party unless one of the exemptions in s.13B(2) applies. The reference to services ‘in relation to the performance of work’ is satisfied if the services performed under the contract are work related.

- The requirement that a practitioner supplies services to a medical centre is satisfied if the practitioner serves patients for or on behalf of the medical centre. This principle has been endorsed by the High Court in Accident Compensation Commission v Odco Pty Ltd [1990] HCA 43; (1990) 95 ALR 641 at 652 (paragraph 30) concerning similar Victorian legislation regulating workers’ compensation.

- This principle has also been applied by courts and tribunals in a range of industries6 including cases involving medical centres.7

- Some factors or terms indicating that a contract between a medical centre and a practitioner would more likely be a relevant contract are provided in Attachment 3. However, each contract must be considered individually on a case-by-case basis taking into account all the relevant facts and circumstances to determine whether it is a relevant contract. If the contract provides, either expressly or by implication, that a practitioner is engaged to supply work-related services to the medical centre by serving patients for or on behalf of the medical centre, the contract is a relevant contract under s.13B(1).

Example 1—Supply of services for or in relation to work by practitioners

ABC Pty Ltd (ABC) operates a medical centre that provides patients with access to a range of medical services performed by qualified practitioners who are engaged by ABC to service patients of ABC.8

Practitioners are engaged by ABC to provide their services to the medical centre by serving patients of the medical centre in accordance with the terms of individual contracts. The contracts also require ABC to provide practitioners a consultation room for patients, manage appointments, maintain patient contact information and medical records, collect fees from patients and pay practitioners a share of revenue.

Each contract between ABC and a practitioner satisfies the requirement to supply services ‘in relation to the performance of work’ under s.13B(1) because practitioners are required to serve patients for or on behalf of ABC.

The elements of a relevant contract under s.13B(1) are satisfied because the services are supplied by each practitioner ‘in the course of a business’ and are supplied ‘in relation to the performance of work’ by the practitioner.

Recent decisions

- The terms and conditions of contracts held to be relevant contracts under equivalent provisions to s.13B(1) in two recent tribunal decisions are summarised below.

The Optical Superstore (TOS) Case

- In the Optical Superstore case, the Victorian Civil and Administrative Tribunal concluded that contracts between TOS and optometrists—or companies or trusts associated with optometrists (‘optometrist entities’)—were relevant contracts under the equivalent provision to s.13B(1) (at [53]). The Tribunal concluded as follows:

- TOS was supplied with the services of optometrists for or in relation to the performance of work.

- The optometrist entities ensured the attendance of optometrists at agreed locations and times, and the optometrists provided optometry services to TOS customers.

- The arrangements also benefitted TOS by potentially leading to increased sales of frames, lenses and other optometry products.

- The services of the optometrists were provided to TOS as well as to the patients.

- The contracts were not tenancies because the optometrists did not have rights to exclusive occupancy, and were more consistent with a contracting arrangement.

- The Tribunal’s decision that some contracts between TOS and optometrist entities were relevant contracts was not challenged by TOS in appeals by the Victorian Commissioner of State Revenue to the Victorian Supreme Court in Commissioner of State Revenue (Vic) v The Optical Superstore Pty Ltd [2018] VSC 524 (see paragraph 16), or to the Victorian Court of Appeal in Commissioner of State Revenue (Vic) v The Optical Superstore Pty Ltd [2019] VSCA 197, which upheld the Commissioner’s assessments.

The Thomas and Naaz Case

- In Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue [2021] NSWCATAD 259 (the Thomas and Naaz case), the NSW Civil and Administrative Tribunal (NCAT) concluded the typical agreement entered into between Thomas and Naaz Pty Ltd (Thomas and Naaz), being the entity that conducted the medical centres, and various doctors was a relevant contract under the equivalent provision to s.13B(1) (at [41]). The Tribunal determined as follows:

- The terms of the agreement indicate the doctors agreed to (at [38]):

- provide services on a five day per week basis, including weekend rosters

- provide advance notice and obtain approval of vacations limited to four weeks per annum

- promote the interests of Thomas and Naaz, including not channelling patients away from its business

- abide by Thomas and Naaz’s operating protocols and complete all necessary documentation

- comply with a restrictive covenant for two years after the doctor departs from the medical practice owned by Thomas and Naaz.

- The terms of the agreement secured the provision of the services provided by the doctors to the patients of Thomas and Naaz’s medical centres. Where such services were a necessary part of Thomas and Naaz’s business, doctors provided their services to the medical centre as well as to patients (at [39]).

- The services provided by the doctors were provided for or in relation to the performance of work, and the services supplied were work-related (at [40]).

- The terms of the agreement indicate the doctors agreed to (at [38]):

- In an appeal by Thomas and Naaz to the Appeal Panel of NCAT in Thomas and Naaz Pty Ltd (ACN 101 491 703) v Chief Commissioner of State Revenue [2022] NSWCATAP 220), Thomas and Naaz argued the Tribunal made an error of law by finding that the doctors provided their services to Thomas and Naaz as well as patients, and by concluding there was a relevant contract. The Appeal Panel rejected these grounds, deciding they were findings of fact and did not raise questions of law. Although these decisions were not reviewed, the Appeal Panel noted the Tribunal’s approach was entirely orthodox and in accordance with binding authority (see paragraphs 64–69).

- An appeal to the New South Wales Court of Appeal (Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue [2023] NSWCA 40) was dismissed.

Engaging a practitioner from practitioner’s entity

- In some cases, a practitioner’s services may be obtained under a contract between a medical centre and a related entity (such as a company) established by the practitioner (practitioner’s entity). A practitioner may be engaged by the practitioner’s entity either as an independent contractor or as an employee.

Example 2—Supply of a practitioner’s services using a company

Federico is a practitioner employed by F Pty Ltd (F Co), which is the trustee of the Federico Family Trust.

ABC Pty Ltd (ABC) enters into a contract with F Co under which F Co is to supply healthcare services at the medical centre conducted by ABC. F Co engages Federico to work as a practitioner at ABC’s medical centre.

F Co, in the course of its business, supplies the services of Federico to ABC, and the services are supplied ‘in relation to the performance of work’.

Exemptions from relevant contract provisions under s.13B(2)

- If an exception (i.e. an exemption) applies under s.13B(2), no payroll tax liability under the relevant contract provisions arises.

- Under s.13B(2), the three exemptions more likely to apply to a contract between a medical centre and a practitioner are:

- The practitioner provides services to the public generally—s.13B(2)(b)(iv).

- The practitioner performs work for no more than 90 days in a financial year—13B(2)(b)(iii).

- Services are performed by two or more persons—13B(2)(c)(i).

- When claiming an exemption, a medical centre must be able to substantiate the exemption with sufficient evidence.

Providing services to the public generally—s.13B(2)(b)(iv)

- A contract between a medical centre and a practitioner is not a relevant contract in relation to a financial year if ss.13B(2)(b)(i) to (iii) do not apply to the services supplied under the contract and the Commissioner is satisfied the practitioner who provided the services under the contract ordinarily performs services of that kind to the public generally in that financial year. A principal (medical centre) which intends to claim this exemption may apply to the Commissioner for an exclusion determination under s.13B(2)(b)(iv) of the Payroll Tax Act (this is not necessary if the principal is using the 10 days or less per month method). The exemption is explained further in Public Ruling PTA021 Contractors who ordinarily perform services to the public.

- To qualify for the exemption, the practitioner must provide services of the same kind to other principals, such as other medical centres or hospitals. For the avoidance of doubt, the reference in s. 13B(2)(b)(iv) to ‘services of that kind’ applies to the services the practitioner performs or renders to the medical centre under the relevant contract.9 It does not refer to the services the practitioner provides to the clients of the medical centre. Therefore, the provision of services to patients for or on behalf of a single medical centre may not satisfy the requirement that services are provided to the public generally (see, for example, Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue [2021] NSWCATAD 259 at [57]-[58]). If a practitioner practises at multiple medical centres but those centres are members of the same group for payroll tax purposes, the medical centre may not be entitled to the exemption (see Public Ruling PTA021).

Example 3—Providing services to the public generally

Example 3.1

ABC Pty Ltd (ABC) operates ABC Medical Centre and engages Dr Taylor under a contract to serve patients at the medical centre. Dr Taylor also provides similar medical services to a range of other principals including medical centres and hospitals during the financial year. Dr Taylor performs work under separate contracts with these principals concurrently during the financial year. The contract between ABC and Dr Taylor is not a relevant contract.

Example 3.2

ABC engages Dr Sou under a contract to provide medical services to patients at its medical centre for 5 five days a week on a full-time basis. Dr Sou is also engaged by Top Care Pty Ltd (Top Care) to provide similar health care services after hours on an ad-hoc basis to Top Care’s patients at their home. Under the contract with Top Care, Dr Sou generally spends 1–2 hours per week serving Top Care’s patients, due to restrictions under Dr Sou’s contract with ABC. The contract for medical services between ABC and Dr Sou is unlikely to be exempt.

Example 3.3

ABC engages Dr Joan to provide medical services to patients at its medical centre and see patients on 3 days per week. Dr Joan is also contracted to provide medical services on 2 days each week to patients of the ABC Private Hospital. ABC Medical Centre and ABC Private Hospital are grouped for payroll tax purposes. Therefore, the 2 ABC entities may seek exclusion determinations before treating the contract with ABC Private Hospital as exempt under the 10 days or less per month method.

Example 3.4

ABC engages Dr Smart to provide medical services to patients at its medical centre (ABC Contract). The ABC Contract is a relevant contract, and none of the exemptions under ss.13B(2)(b)(i)-(iii) apply. Further, Dr Smart is also a common law employee of Queensland Health. As a common law employee, Dr Smart provides medical services to patients at hospitals operated by Queensland Health. For applying s.13B(2)(b)(iv) to the ABC Contract, Dr Smart would be viewed as providing her services to two business operators but not to the public generally, despite the fact the medical centre and Queensland Health may offer their services to the public generally. The ABC Contract is unlikely to be exempt.

Working for 90 days or less in a financial year—s.13B(2)(b)(iii)

- If a practitioner performs work under a contract for no more than 90 days during a financial year, the contract is exempt for that financial year. Each calendar day on which the practitioner performs work counts as 1 day, regardless of the time spent working on a particular day. The exemption is explained in Public Ruling PTA035 Contractors–90-day exemption and Public Ruling PTA014 What constitutes a day’s work?

Example 4—Practitioner works for no more than 90 days

Janis is engaged as an optometrist by ABC Optometry Pty Ltd (ABC Optometry) on 14 April 2018 until 31 October 2020.

This equates to 78 days for the financial year ended 30 June 2018 (FY18), 365 days for the financial year ended 30 June 2019 (FY19), 365 days for the financial year ended 30 June 2020 (FY20) and 123 days for the financial year ended 30 June 2021 (FY21). The contract requires Janis to be available to work 6 days per week for a minimum of 5 hours per day.

For FY18, Janis did not work on more than 90 days, therefore the contract is exempt for that financial year. A copy of the signed and dated contract and financial records indicating the payments made to Janis is sufficient evidence to satisfy the Commissioner the exemption applies for FY18.

For FY19 and FY20, Janis worked on an average of 5 days per week. The exemption does not apply because Janis worked more than 90 days.

For FY21, as an average of 5 days per week would be under 90 days, the exemption may apply. However, ABC Optometry would need sufficient evidence to substantiate the exemption applies; for example, attendance records or other evidence indicating the days on which Janis provided services to patients being 90 days or less.

Services performed by two or more persons—s.13B(2)(c)(i)

- This exemption applies if a medical centre contracts with a practitioner, and the practitioner and at least one other person employed by or who provides services for the practitioner perform the work required under the contract.

- The second person that provides services to or for the practitioner may be a company, but the work must be performed by a natural person.

- The work performed by the second person must be work required to be performed under the contract between the medical centre and the practitioner.

- The exemption does not apply if:

- the second person is engaged by the medical centre, not by the practitioner, to provide the services

or - the second person provides general business-related services that are not required to be provided to the medical centre under the relevant contract (e.g. tax, accounting or business advisory services provided to the practitioner).

- the second person is engaged by the medical centre, not by the practitioner, to provide the services

- A practitioner or the practitioner’s entity that employs or engages another person in the course of a business carried on at a medical centre may be grouped with the medical centre under s.70 (groups arising from the use of common employees). Public Ruling PTA017 Grouping of professional practices and administration businesses explains the application of the grouping provisions to professional practices and service entities.

Example 5—Practitioner engages a second person to perform services

ABC Pty Ltd (ABC) operates a dental clinic and engages dentists to provide dental services to patients.

Under a contract, Joanne is engaged by ABC as a specialist to provide complex procedures to patients and Joanne employs a specialist nurse to assist her in those procedures.

The contract between ABC Dental and Joanne is exempt.

Example 6—Medical centre engages a second person to perform services

The same facts in Example 5 except ABC, and not Joanne, employs a specialist nurse to assist Joanne in performing complex dental procedures.

The ‘2 or more persons’ exemption does not apply because the nurse is employed by the medical centre, not by Joanne.

Example 7—Second person does not perform work required under the contract

Who is the employer under s.13C?

- Section 13C(1) deems the employer under a relevant contract to be the person:

- who supplies services to another person

or - to whom the services of persons are supplied.

- who supplies services to another person

- Paragraph 13C(1)(c) applies to a person who gives goods to individuals and is not generally applicable in relation to contracts involving medical centres.

- If both paragraphs (a) and (b) under s.13C(1) apply to a relevant contract, s.13C(2) provides the person who is supplied with the services of another person is deemed to be the employer.

- Applying s.13C(1)(b) to a relevant contract between a medical centre and a practitioner, the medical centre is taken to be the employer because it receives the services of the practitioner who serves the patients. Those services are work-related because the practitioner performs work in the course of supplying the services. (See, for example: Accident Compensation Commission v Odco Pty Ltd [1990] HCA 43; (1990) 95 ALR 641 at 652 (paragraph 30); The Optical Superstore Pty Ltd v Commissioner of State Revenue [2018] VCAT 169 at [82].)

Example 8—Medical centre is taken to be an employer

ABC Pty Ltd (ABC) operates a medical centre and enters into relevant contracts with several practitioners to provide medical services to patients for or on behalf of ABC.

ABC is taken to be the employer under each relevant contract because it is supplied with the services of practitioners who serve the patients. In supplying services to patients, the practitioner supplies services to ABC in the form of work.

Who is the employee under s.13D?

- Under s.13D(1)(a), a person who performs work in relation to which services are supplied to another person under a relevant contract is taken to be an employee.

- Paragraph 13D(1)(b) only applies to a relevant contract under which goods are resupplied.

- Under a relevant contract between a medical centre and a practitioner, the practitioner, being the person who performs the work required under the contract, is taken to be the employee (see, for example: The Optical Superstore Pty Ltd v Commissioner of State Revenue [2018] VCAT 169 at [82]; Homefront Nursing Pty Ltd v Chief Commissioner of State Revenue [2019] NSWCATAD 145 at [46]). If the relevant contract is between a medical centre and a practitioner’s entity, and the practitioner’s entity engages the practitioner to provide services under a separate contract with the practitioner, the practitioner is taken to be an employee under s.13D.

Example 9—Practitioner taken to be an employee

ABC Pty Ltd (ABC) operates a medical centre and enters into a relevant contract with P Pty Ltd to obtain the services of Dr Peters who is engaged by P Pty Ltd to provide medical services to patients for or on behalf of ABC.

Dr Peters is taken to be an employee of ABC under s.13D because Dr Peters performs the work in relation to which medical services are supplied under the relevant contract.

Deemed wages—common payment arrangements

- The following common payment arrangements between a medical centre and a practitioner under a relevant contract have been identified and are discussed further below. Whether certain payments to the practitioner are considered deemed wages is summarised in this table.

| Payment arrangement | Deemed wages | Paragraphs and examples |

|---|---|---|

| Medicare benefit assigned by the patient to the practitioner, and any additional out-of-pocket patient fees (‘patient revenue’) paid to the medical centre on behalf of or directed by the practitioner, then payment from the medical centre to the practitioner (net of any administration fee) | Yes | Paragraphs 51–53

Example 10 |

| Patient revenue paid to the medical centre on behalf of or directed by the practitioner, then payment from the medical centre to the practitioner’s entity (net of any administration fee) | Yes | Paragraphs 54, 55 and 65

Examples 11 and 15 |

| Medicare benefit assigned by the patient to the practitioner and paid directly to the practitioner from Medicare | No | Paragraph 60–63

Example 12 |

| Out-of-pocket patient fees paid directly to the practitioner from the patient | No | Paragraph 64

Example 13 |

| Patient revenue paid into an account and only released with the approval of the medical centre | Yes | Paragraphs 65–66

Example 14 |

| Patient revenue paid to a third-party entity, then paid from the third-party entity to the practitioner | Yes | Paragraphs 67–70

Examples 16–19 |

Which payments are deemed wages under s.13E?

- Under s.13E(1) amounts paid or payable under a relevant contract by a medical centre (the deemed employer) are wages for payroll tax purposes if the payments are in relation to the performance of work relating to the relevant contract by the deemed employee. The situations where practitioners are paid by third parties or by patients directly are discussed separately at paragraphs 56–70.

- The phrase ‘in relation to work’ requires either a ‘direct’ or ‘indirect’ relationship between the payment and the performance of work (see Commissioner of State Revenue (Vic) v The Optical Superstore Pty Ltd [2019] VSCA 197 at [65]). In Thomas and Naaz the Tribunal decided (at [67]–[68]) that there was such an ‘indirect’ relationship where the contractual relationship included the following characteristics:

- the doctors provided the services to patients

- the patients assigned their medical benefits to the doctors

- Thomas and Naaz, on behalf of the doctors, submitted the assigned claims for the medical benefits to Medicare

- Medicare paid those benefits to Thomas and Naaz

- Thomas and Naaz retained 30% of the amounts received from Medicare and paid the remaining 70% to the doctors as the payments.

- It does not matter that payments to a practitioner are paid from money received by the medical centre on behalf of practitioners, whether from ‘out-of-pocket’ patient fees or assigned Medicare benefit from patients, even if the practitioner is beneficially entitled to that money (see Commissioner of State Revenue (Vic) v The Optical Superstore Pty Ltd [2019] VSCA 197 at [67]). When the practitioner’s entitlement is recognised and the money is paid or becomes payable, it constitutes wages for payroll tax purposes.

Example 10—Payments by a medical centre to practitioners taken to be wages

Under relevant contracts with practitioners, ABC Pty Ltd (ABC)—which operates a medical centre—is paid out-of-pocket patient fees, in addition to assigned Medicare benefits from patients (patient revenue) on behalf of or directed by the practitioners. All patient revenue is paid to ABC and deposited in ABC’s bank account.

Each practitioner is paid 70% of the patient revenue attributable to the practitioner for their services, ABC retains 30% of the patient revenue as an administration fee.

On the last working day of each month, each practitioner’s share of patient revenue for the month is calculated and paid to the practitioner’s nominated bank account within 5 days.

The amounts paid or payable to each practitioner under the relevant contract are taken to be ‘wages’ paid or payable by ABC.

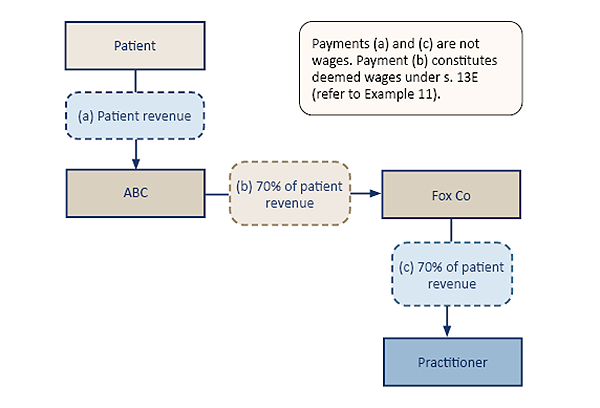

- If a practitioner’s services are provided under a relevant contract between a medical centre and the practitioner’s entity, and the practitioner is taken to be an employee of the medical centre, payments by the medical centre to the practitioner’s entity that are in relation to the performance of work related to the relevant contract are taken to be wages.

Example 11—Payments by a medical centre to a practitioner’s company taken to be wages

Under a relevant contract between ABC Pty Ltd (ABC)—which operates a medical centre—and Fox Pty Ltd (Fox Co), ABC is deemed to be an employer and Dr Fox, whose services are provided under the contract, is taken to be an employee. All payments outlined in this example are governed by the relevant contract.

ABC is required to pay to Fox Co (a company owned and controlled by Dr Fox) 70% of the patient revenue attributable to Dr Fox as a deemed employee of ABC. The remaining 30% of patient revenue is retained by ABC as an administration fee.

The amounts paid or payable by ABC to Fox Co are taken to be ‘wages’ paid or payable by ABC. ABC makes these payments in return for the performance of work by Dr Fox for ABC. It is not a requirement that the payments are made to the deemed employee.

The source of the funds used to pay the practitioner’s company does not affect the classification of an amount as wages, even if the payment is made from money held in a trust account for the practitioner or the practitioner’s entity (see Commissioner of State Revenue (Vic) v The Optical Superstore Pty Ltd [2019] VSCA 197 at [64]-[68]).

- If a payment by a medical centre to a practitioner includes an amount that is not attributed to the performance of work, only the amount paid for the performance of work is subject to payroll tax. A payment for something other than the performance of work is not subject to payroll tax, but it must be substantiated with sufficient evidence that the practitioner is required to provide it under the contract. Reimbursement of general business expenses of the practitioner cannot be claimed as a deduction from payments by the medical centre that are taken to be wages under s.13E(1).

Third-party payments taken to be wages under s.51

- Under s.51, ‘third-party payments’ of money or other consideration may be taken to be wages paid or payable by an employer to an employee. This provision applies to a third-party payment under a relevant contract that would be wages if paid by an employer to an employee under the contract.

- A person taken to be an employer under s.13C is taken to be an employer under s.51, and a person taken to be an employee under s.13D is taken to be an employee under s.51.

- A third-party payment may consist of:

- a payment by a person other than a deemed employer to a deemed employee

- a payment by a deemed employer to a person other than a deemed employee

- a payment by a person other than a deemed employer to a person other than a deemed employee.

Assignment and payment of Medicare benefits and out-of-pocket patient fees from patients to practitioners

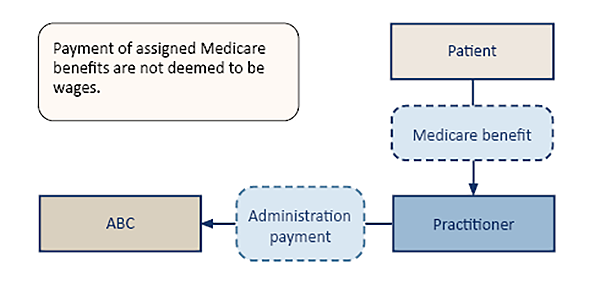

- Under normal business arrangements, the payment of an assigned Medicare benefit to a practitioner and the payment of out-of-pocket patient fees from patients directly to practitioners will not constitute wages under either s.13E or s.51.

Medicare benefits

- A patient who incurs expenses for medical or pathology services is entitled to receive Medicare benefits from the Commonwealth Government under the Health Insurance Act 1973 (Cwlth) (HIA Act).10 Further, the Medicare benefit is payable by Medicare on behalf of the Commonwealth Government to the patient who incurs the medical expense.11

- Instead of the patient paying the practitioner for a medical service and then claiming the Medicare benefit from the Commonwealth Government, the patient may enter into an agreement with the practitioner whereby the patient assigns the right to payment of the benefit to the practitioner and the practitioner accepts the assignment in full payment for the service.12 The Medicare benefit is payable in accordance with the assignment or agreement.13 Under a relevant contract between a medical centre and a practitioner, where a patient assigns their right to the Medicare benefit to the practitioner and the benefit is paid directly to the practitioner (i.e. rather than to the medical centre on behalf of or directed by the practitioner), the payment of the benefit is not taken to be wages as a ‘third-party payment’ under s.51.

- The payment of the assigned Medicare benefit to the practitioner is not considered to be wages under s.13E, because it is not paid or payable by the deemed employer (the medical centre) under the relevant contract.

- Further, assigned Medicare benefits are not paid or given (or to be paid or given) for an ‘employee’s services as an employee of an employer’ under s.51(1)(a). Instead, the payment of the Medicare benefit is a statutory payment pursuant to the HIA Act that the patient has assigned. On accepting the assignment, the practitioner has a right enforceable at law against Medicare.14 Whether the practitioner has provided medical treatment in the capacity as a deemed employee is immaterial to the making of the payment.

Example 12—Assigned Medicare benefits paid directly to a practitioner

ABC Pty Ltd (ABC)—which operates a medical centre—enters into a contract with Dr Lyle who agrees to treat patients for or on behalf of ABC. The contract is a relevant contract under s.13B(1) and none of the exemptions under s.13B(2) apply.

ABC is taken to be an employer under s.13C. Dr Lyle is taken to be an employee under s.13D(1)(a).

The contract between ABC and Dr Lyle provides the Medicare benefit for each patient treated by Dr Lyle is assigned to her and the benefit is paid directly to Dr Lyle (rather than the benefit being paid to ABC on behalf of or as directed by Dr Lyle).

The assigned Medicare benefit payments to Dr Lyle are not taken to be wages under s.13E because there is no payment by the deemed employer (ABC). Further, such payments are not deemed to be wages under s.51 because they are for the payment of a statutory benefit under the HIA Act rather than for Dr Lyle’s services as a deemed employee.

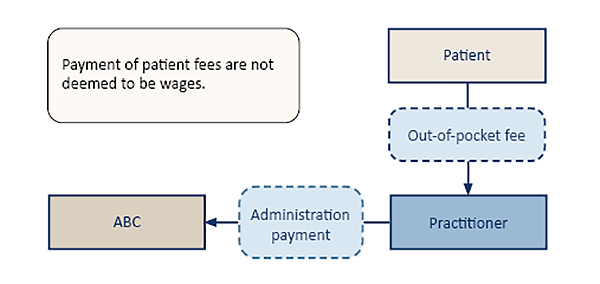

Payment of out-of-pocket patient fees from patient to practitioner

- Where a patient pays out-of-pocket patient fees—in addition to any assigned Medicare benefit—directly to the practitioner (i.e. rather than to the medical centre on behalf of or directed by the practitioner), those payments are not considered to be deemed wages under s.13E because they are not paid or payable by the deemed employer (the medical centre). Further, the payment of out-of-pocket patient fees directly to the practitioner are not deemed to be wages under s.51 because they are not paid or given by the patient for the practitioner’s services as an employee, but rather for the provision of medical services to the patient.

Example 13—Out-of-pocket patient fees paid directly to a practitioner

The same facts as Example 12, except the patients Dr Lyle treats also pay any out-of-pocket patient fees directly to her. These payments are not taken to be wages under s.13E because they are not paid or payable by ABC under a relevant contract. Further, such payments are not taken to be wages under s.51 because the payment is for the provision of medical services to the patient and not for Dr Lyle’s services as a deemed employee of ABC.

- However, further to paragraph 61 and 64 above, assigned Medicare benefits and/or out-of-pocket patient fees (patient revenue) that are not in fact paid directly to the practitioner may be deemed wages. That is, if certain banking arrangements in fact involve an initial payment by the patient followed by one or more further payments by the medical centre or a third-party, then these further payments may be deemed wages.

- A further payment may be made even if no money directly flows from the medical centre to the practitioner.15 Close consideration must be given to whether, under the relevant contract, the practitioner’s ability to access the patient revenue paid to them is conditional on the approval or direction of the medical centre (see Example 14 below). Each payment arrangement will be considered on a case-by-case basis to determine whether the payment(s) are deemed wages.

Example 14—Assigned Medicare benefits and out-of-pocket patient fees not paid directly to a practitioner

XYZ Pty Ltd (XYZ)—which operates a medical centre—enters into a contract with Dr Jones who agrees to treat patients for or on behalf of XYZ. The contract is a relevant contract under s.13B(1) and none of the exemptions under s.13B(2) apply.

XYZ is taken to be an employer under s.13C. Dr Jones is taken to be an employee under s.13D(1)(a).

The relevant contract provides the patient revenue for each patient treated by Dr Jones is to be paid to the ‘XYZ Doctors Reconciliation Account’ (patient payments). This is a joint bank account with Big Bank Limited held in the names of XYZ and every doctor working at XYZ’s medical centre. Every other doctor working at the medical centre has entered into a substantively similar relevant contract with XYZ.

The relevant contract provides that money may only be withdrawn or transferred from the XYZ Doctors Reconciliation Account in the circumstances set out in the relevant contract. Neither XYZ nor Dr Jones can unilaterally withdraw or transfer monies from the XYZ Doctors Reconciliation Account. Big Bank Limited agrees it will not allow the account holders to withdraw monies except in the circumstances outlined below.

The relevant contract provides that every fortnight 70% of the patient payments attributable to Dr Jones will be paid into a bank account of Dr Jones’s choosing (the fortnightly payments), provided the other conditions of the relevant contract are satisfied.

The patient payments are not taken to be deemed wages under s.13E because there is no payment by the deemed employer (XYZ). Further, the patient payments would not be deemed wages under s.51 because:

- In the case of the assigned Medicare benefits, they are for the payment of a statutory benefit under the HIA rather than for Dr Jones’ services as a deemed employee

- In the case of the out-of-pocket patient fees, they are payment for Dr Jones’ medical services and not payment for his services as a deemed employer of XYZ.

In contrast, the fortnightly payments would be deemed wages under s.51(1). The fortnightly payments are consideration for Dr Jones’ services as a deemed employee of XYZ that would have been wages if they had been paid or payable by XYZ (a deemed employer) to Dr Jones (a deemed employee).

Other third-party payments to practitioners and practitioner entities

- Assigned Medicare benefits and any out-of-pocket patient fees paid by the medical centre to the practitioner’s entity may be wages under s.13E (as outlined at Example 11). In those cases any subsequent payments from the practitioner’s entity to the practitioner will not be wages.

Example 15—Wages paid by a medical centre to practitioner’s entity (s.51(1))

Same facts as Example 11.

All out-of-pocket patient fees and assigned Medicare benefits from patients (patient revenue) are collected by and paid to ABC.

The payments of patient revenue from patients to ABC are not taken to be wages under s.51 for similar reasons outlined in paragraphs 59–64 and Examples 12 and 13.

Further, under the relevant contract between ABC and Fox Co, the payment of 70% of patient revenue from ABC to Fox Co is subsequently paid by Fox Co to Dr Fox, either in whole or in part and not as a dividend (the ‘subsequent payments’).

Similarly, any subsequent payments from Fox Co to Dr Fox will not be taken to be wages under s.51 because the payments would not be characterised as payment for the practitioner’s services in the capacity as a deemed employee of ABC.

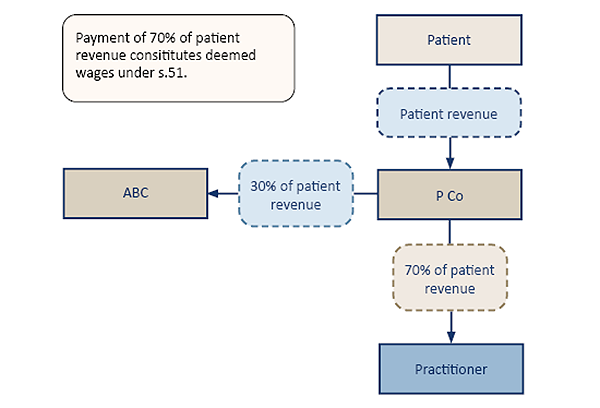

- In contrast to the above, assigned Medicare benefits and any out-of-pocket patient fees paid by third parties to the practitioner or to the practitioner’s entity may be wages under s.51.

Example 16—Wages paid by a third party to a practitioner (s.51(1))

ABC Pty Ltd (ABC)—which operates a medical centre—enters into a contract with Dr Wolf who agrees to treat patients for or on behalf of ABC. The contract is a relevant contract under s.13B(1) and none of the exemptions under s.13B(2) apply.

ABC is taken to be an employer under s.13C. Dr Wolf is taken to be an employee under s.13D(1)(a).

The contract provides patient fees including assigned Medicare benefits from patients and any out-of-pocket patient fees (patient revenue) attributable to Dr Wolf for his services are paid directly by patients to P Pty Ltd (P Co), a third-party clearing house.

At the end of each month P Co is required to pay 30% of the patient revenue to ABC and 70% to Dr Wolf.

Under s.51(1), the payments by P Co to Dr Wolf are taken to be wages paid by ABC to Dr Wolf because the payments are consideration for the services of Dr Wolf that would have been wages if they had been paid or payable by ABC (a person taken to be an employer) to Dr Wolf (a person taken to be an employee).

- If a practitioner’s services are provided under a relevant contract and the practitioner is taken to be an employee of the medical centre, and under the contract patient revenue is paid directly by patients to the practitioner’s entity, payments from the practitioner’s entity to the practitioner in relation to the performance of work related to the relevant contract are taken to be wages.

Example 17—Wages paid by practitioner’s entity to practitioner (s. 51(1))

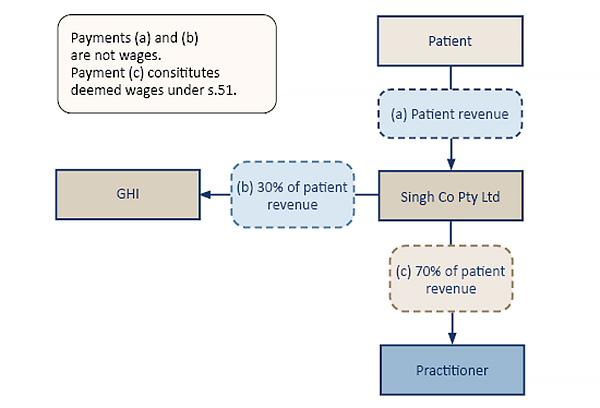

GHI Pty Ltd (GHI)—which operates a medical centre—enters into a contract with Dr Singh who agrees to treat patients for or on behalf of GHI. The contract is a relevant contract under s.13B(1) and none of the exemptions under s.13B(2) apply. All payments outlined in this example are governed by the relevant contract.

GHI is taken to be an employer under s.13C. Dr Singh is taken to be an employee under s.13D(1)(a).

Under the contract, Singh Co Pty Ltd (Singh Co)—a company owned and controlled by Dr Singh—is paid directly all assigned Medicare benefits from patients and any out-of-pocket patient fees (patient revenue) attributable to Dr Singh for their services to GHI.

At the end of each month Singh Co is required to pay GHI 30% of the patient revenue as an administration fee. The remaining 70% of patient revenue is subsequently paid by Singh Co to Dr Singh, either as a whole or in part, and not as a dividend (the ‘practitioner payment’).

The patient revenue paid to Singh Co is not taken to be wages under either s.13E or s.51(1) for similar reasons outlined in paragraphs 59—64 and Examples 12 and 13. These payments are not for Dr Singh’s services as a deemed employer of GHI; and had the payments been made directly by GHI to Dr Singh, the payment would not be wages as the relevant contract contemplates Dr Singh will be remunerated by Singh Co.

In contrast, under s.51(1) the practitioner payments from Singh Co to Dr Singh are taken to be wages paid by GHI to Dr Singh. This is because the payments are consideration for the services of Dr Singh as a deemed employee of GHI that would have been wages if they had been paid or payable by GHI (a deemed employer) to Dr Singh (a deemed employee).

Example 18—Wages paid by medical centre trust to the practitioner (s.51(1))

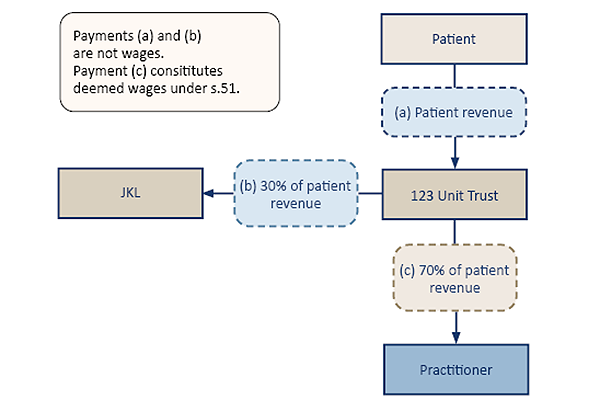

JKL Pty Ltd (JKL)—which operates a medical centre—enters into a contract with Dr Lopez who agrees to treat patients for or on behalf of JKL. The contract is a relevant contract under s.13B(1) and none of the exemptions under s.13B(2) apply. All payments outlined in this example are governed by the relevant contract.

JKL is taken to be an employer under s.13C. Dr Lopez is taken to be an employee under s.13D(1)(a).

Under the contract, all assigned Medicare benefits from patients and any out-of-pocket patient fees attributable to Dr Lopez for their services (patient revenue) are paid directly to 123 Pty Ltd as trustee for the 123 Medical Centre Unit Trust (123 Unit Trust). JKL owns and controls 123 Pty Ltd and the 123 Unit Trust. Dr Lopez is a unitholder of the 123 Unit Trust.

At the end of each month the 123 Unit Trust is required to pay 70% of the patient revenue by way of a trust distribution from the 123 Unit Trust to Dr Lopez (‘practitioner payments’). The remaining 30% of the patient revenue is retained by the 123 Unit Trust as an administration fee.

The patient revenue paid to the 123 Unit Trust is not taken to be wages under either s.13E or s.51(1) for similar reasons outlined in paragraphs 59–64 and Examples 12 and 13 above. These payments are not for Dr Lopez services as a deemed employer of JKL; and, had the payments been made directly by JKL to Dr Lopez, the payment would not be wages as the relevant contract contemplates Dr Lopez will be remunerated from the 123 Unit Trust.

Under s.51(1), the practitioner payments from the 123 Unit Trust to Dr Lopez are taken to be wages paid by JKL to Dr Lopez. This is because the payments are consideration for the services of Dr Lopez that would have been wages if they had been paid or payable by JKL (a deemed employer) to Dr Lopez (a deemed employee). The fact the payments are trust distributions to which Dr Lopez was already beneficially entitled does not preclude such payments from being characterised as wages.16

Example 19—Wages paid by practitioner’s own trust to practitioner (s.51(1))

The same facts as Example 18, except the 123 Unit Trust is controlled by Dr Lopez.

Under s.51(1), the payments from the 123 Unit Trust to Dr Lopez by way of a trust distribution would be taken to be wages.

- For the avoidance of doubt, the payments from the 123 Unit Trust in Examples 18 and 19 would still be taken to be wages under s.51(1) even if 123 Unit Trust was a discretionary trust.

Other matters

Tenancy contract that is not a relevant contract

- Under a tenancy contract, a landlord (who may be a sub-lessor) by lease or licence provides a practitioner with use of a suite or space in, for example, a building from which the practitioner conducts their own independent medical practice. The tenancy contract will reference the specific space being leased or licensed and generally includes provisions for fit-out and alterations to accommodate the practitioner’s requirements and services such as building maintenance and signage for the practitioner’s operating hours.

- A tenancy contract is not a relevant contract if the practitioner does not supply work-related services to patients for or on behalf of the landlord. In these circumstances, the practitioner must operate their own independent medical practice responsible for such matters as advertising and attracting patients, providing medical services to their own patients (i.e. not for or on behalf of anyone else), managing patient appointments and records and directly submitting claims for medical benefits to Medicare; with Medicare paying those benefits to the practitioner (or the practitioner’s entity).

- If a tenancy contract refers to a medical centre as a ‘landlord’ and the practitioner as a ‘tenant’, but in substance the practitioner is providing medical services for or on behalf of the medical centre to its patients, the tenancy contract is more likely to be a relevant contract.

Example 20—Tenancy contract not a relevant contract

Example 21—Tenancy contract is a relevant contract

A contract with an administration entity may be a relevant contract

- Multiple medical practices conducted by individual practitioners may operate from the same premises and use the same entity that provides administration and support services (administration entity) to practitioners. A contract with the administration entity may be a relevant contract depending on the terms and conditions of each contract. In some cases a contract may be a relevant contract under s.13B(1), but an exemption may apply under s.13B(2). The terms and conditions of each contract must be considered on a case-by-case basis having regard to ‘When is a contract a relevant contract?’ above.

Grouping of practitioners and administration entities

- An entity that provides administration services only to practitioners may be grouped with practitioners or the practitioners’ entity under Part 4. Public Ruling PTA017 Grouping of professional practices and administration businesses explains the application of the grouping provisions to professional practices and service entities.

Reference to practitioner being ‘principal’ not determinative

- A contract between a medical centre and a practitioner may state the practitioner is the principal, and/or the medical centre only provides administrative services to the practitioner. Such clauses do not prevent the application of the relevant contract provisions if the medical centre is able to exercise operational or administrative control over the services provided to patients, or is able to exercise operational or administrative control over a practitioner to influence decisions about who practises at the centre, when they practise, and the space within the centre where that occurs. The manner in which the parties describe or label their relationship in contract cannot change the character of the relationship established by their rights and obligations.17

Example 22—Practitioner referred to and described as ‘principal’

- This principle is also illustrated in Example 21 where, despite the parties being referred to and described as ‘tenant’ and ‘landlord’, the reference and description adopted does not change the legal relationship of the parties in determining the tenancy contract is a relevant contract. The same principle applies where a medical centre business is referred to or described as a ‘health complex’, ‘medical centre suites’ or a ‘medical and health precinct’.

Actual conduct may be relevant

- In some cases the actual conduct of the parties under the contract will not accord with its written terms. This may indicate the parties’ rights and duties are not comprehensively committed to a written contract, that the contract has been varied or that the contract is a sham. In those circumstances the Commissioner will consider all the relevant facts when determining whether a contract is a relevant contract and if payments are wages.

Example 23

Medicare provider number

- A practitioner, being an eligible health professional, must apply for a unique Medicare provider number (MPN) to provide services listed under the Medical Benefits Schedule (MBS) and, where eligible, refer patients to relevant specialists and/or consultant physicians and request certain imaging and pathology services. Further, an MPN is required to access and claim Medicare services and benefits. Only an eligible health professional, being a natural person, can be a granted an MPN meaning the medical services under the MBS are provided by a practitioner to a patient.

- The MPN requirement does not alter the outcome that, under a relevant contract, where a practitioner is engaged by a medical centre to serve patients for or on behalf of the medical centre, the practitioner is still providing medical services to the medical centre and to the patients, consistent with the principles determined in the Optical Superstore Case and the Thomas and Naaz Case.

Records must be kept for at least 5 years

- Medical centres must keep records that enable their tax liability under the Act to be properly assessed and must keep the records for a minimum of 5 years after the end of the financial year in which wages were paid or became payable (see Part 9 of the Taxation Administration Act 2001).

- An employer who disputes the correctness of a payroll tax assessment in an objection to the Commissioner or in a request for review by the Queensland Civil and Administrative Tribunal or an appeal to the Supreme Court bears the onus of proving the assessment was incorrect on the balance of probabilities (see ss.66, 70A and 73 of the Taxation Administration Act).

Date of effect

- This public ruling takes effect from the date of issue.

Simon McKee

Commissioner of State Revenue

Date of issue: 3 March 2025

References

| Public Ruling | Issued | Dates of effect | |

|---|---|---|---|

| From | To | ||

| PTAQ000.6.5 | 3 March 2025 | 1 December 2024 | Current |

| PTAQ000.6.4 | 6 December 2024 | 1 December 2024 | 27 February 2025 |

| PTAQ000.6.3 | 21 February 2024 | 21 February 2024 | 30 November 2024 |

| PTAQ000.6.2 | 19 September 2023 | 19 September 2023 | 20 February 2024 |

| PTAQ000.6.1 | 22 December 2022 | 22 December 2022 | 18 September 2023 |

Attachment 1

Determining whether a medical centre business is being conducted

Outlined below are factors to consider in determining whether an entity is conducting a medical centre business, for the purpose of this ruling. These factors are not exhaustive and the absence of one or more will not necessarily mean a medical centre business is not being conducted.

| Medical centre business | Administrative service business | |

|---|---|---|

| a. | The business holds out, promotes and advertises to the public as a place where medical services are available and provided to the public. | The business is held out, promoted and advertised to the public as an administrative services business, unrelated to the provision of medical services. |

| b. | The business operator enters into a contract or arrangement with practitioners, pursuant to which the practitioner promises to provide medical services to the patients of the medical centre. | The practitioner does not promise to provide medical services to the business operator. |

| c. | The business operator determines bulk billing practices, patient fees and concessional arrangements for medical services offered to patients. | The business operator does not determine and has no involvement in patient billing practices. |

| d. | When a member of the public (patient) enters the reception area at the medical centre, the person does so at the invitation of the medical centre. | A member of the public being a patient would not ordinarily enter the business for the purpose of receiving medical services. |

| e. | The business operator has concern for patient dissatisfaction with the availability and quality of medical services provided at the medical centre. | The business operator would have no concern regarding patient dissatisfaction, having no connection to the provision of administrative services. |

| f. | The business is conducted in a manner to attract patients to the medical centre. | The business is conducted in a manner to secure practitioners that pay fees for administration services provided to the practitioners. |

| g. | The business operator determines the physical configuration and layout of the medical centre premises for the provision of medical services. | The business operator does not determine and has no involvement in the physical configuration and layout of the medical centre premises and merely provides a room or space. |

| h. | The business operator determines the composition of practitioners who provide services at the medical centre. | The business operator has no involvement in the composition of practitioners who provide services at the medical centre, having no connection to the provision of administrative services. |

| i. | The business operator determines the nature of the medical services available at the medical centre. | The business operator has no involvement in the nature of the medical services provided at the medical centre, having no connection to the provision of administrative services. |

| j. | The business operator determines the specific location within the medical centre where each practitioner provides medical services to patients. | The business operator has no involvement in the specific location from which each practitioner provides medical services to patients, and merely provides a room or space. |

| k. | The business operator determines the roster to be worked by practitioner(s). | The business operator complies with the roster determined by the practitioner(s) and provides administrative services as required. |

| l. | The business operator determines the hours when the medical centre will be open to receive patients. | The business operator complies with the operating hours determined by the medical centre and provides administrative services as required. |

| m. | The business operator retains control and ownership over patient records at all times. | The business operator has no control or ownership over patient records, except to the extent required for the provision of administration services. |

| n. | Restrictive covenants placed on practitioners include an exclusivity restraint and a restraint of trade following completion or termination of the agreement. | Restrictive covenants placed on practitioners include restrictions on acquiring administrative services from other third-party providers. |

| o. | Termination of a practitioner as a result of committing an act that adversely affects the reputation of the medical centre. | Termination of a practitioner as a result of failing to comply with contractual obligations (e.g. not paying fees for administration services or becoming insolvent). |

| p. | Commercial success and profit of the business is a function of the degree to which patients are attracted to the medical centre | Commercial success and profit of the business is a function of the degree of utilisation by the practitioners of administration services, not the medical services provided by practitioners. |

Attachment 2

Factors which may be influenced indicating ‘operational or administrative control’

The medical centre is considered to have ‘operational or administrative’ control over a practitioner if it is able to influence matters in the relationship between the medical centre and practitioner. For example, the practitioner is subject to the following:

- specified period of work including, for example, attendance and availability, prescribed days and hours to be worked, set start and finish times and public holiday requirements

- leave policy including, for example, specified leave entitlements, the requirement to provide advanced notice of planned leave, certain limitations on leave (e.g. timing and duration) and leave approval

- directed to provide medical services to patients from a physical location (e.g. specific medical centre) and space within the medical centre as required

- compliance with operating protocols including, for example, meeting roster commitments, being physically present during rostered sessions, sign-in and sign-out procedures, and completion of necessary documentation

- promotion of the business and interest of the medical centre including, for example, expanding the turnover and patient base of the practice, upholding the quality and image of the services provided and not channelling patients away from the medical centre

- property in business records remains with the medical centre at all times including, for example, an obligation that the practitioner must promptly provide the medical centre with all information and documents as required at any time during and following completion or termination of the agreement

- control and property in patient records remains with the medical centre at all times including, for example, an obligation that practitioners must not copy patient records or remove them from the medical centre during the agreement and practitioners are prevented from or limited to accessing patient records following completion or termination of the agreement

- patient fee and payment protocols including, for example, an obligation that the practitioner is required to bulk bill patients for services, charge patients based on rates set by the medical centre and adopt concessional arrangements as directed (e.g. reduced fees for infants, veterans)

- types of restrictive covenants including, for example, an exclusivity restraint during the agreement and a restraint of trade following completion or termination of the agreement.

The above factors are indicative only and are not exhaustive. The extent of ‘operational or administrative’ control between a medical centre and practitioner must be considered on a case-by-case basis, taking into account all the relevant facts and circumstances.

Attachment 3

Factors and terms indicating a contract is more likely to be a relevant contract

Whether an arrangement between a medical centre and a practitioner is a relevant contract depends on if:

- the medical centre conducts a business of providing medical services to patients

- there is an arrangement between the medical centre and the practitioners whereby the practitioners will provide medical services to patients of a medical centre

- payment or remuneration of some kind will be provided in return for the services supplied by the practitioner to patients of the medical centre.

The following factors and contractual terms between a medical centre and a practitioner, or the practitioner’s entity, indicate the contract is more likely to be a relevant contract:

- The medical centre and the practitioner agree that the practitioner will provide competent, professional medical services to patients of the medical centre.

- The medical centre controls the manner in which services are provided, specifically the extent to which the medical centre can influence those factors in the relationship between the medical centre and practitioner outlined in Attachment 2.

- The medical centre determines patient fee arrangements, including decisions as to which patients may be only bulk billed to Medicare, the extent of out-of-pocket patient fees charged, payments by the Department of Veterans’ Affairs (DVA) and other specified fees and amounts paid or payable.

- The medical centre determines how patients’ fees (including assigned Medicare benefits) are shared between the medical centre and the practitioner or the practitioner’s entity. The mechanism by which the medical centre calculates the payment to the practitioner or practitioner’s entity (e.g. as an hourly rate, a percentage of billing or a variable management fee) will not in itself change whether the payments are wages.

- The medical centre directs the assignment and administers the payment of an assigned Medicare benefit or DVA benefit from the patient to the medical centre.

- Provision is made for the practitioner to periodically invoice the medical centre for services provided to the medical centre; for example, by serving patients for or on behalf of the medical centre.

- Hours or days of attendance by the practitioner are specified.

- The practitioner’s entitlement to take a leave of absence is specified, including any requirement to seek approval from the medical centre or to ensure a minimum number of practitioners are available to serve patients.

- The practitioner is required to provide the medical centre with specified information and documents.

- Ownership of, and access to records, including patient information is controlled and retained by the medical centre and not the practitioner.

- There are restrictions on copying or removing records from the medical centre.

- The practitioner is required to promote the interests and welfare of the medical centre.

- The practitioner is required to commit to provide a share of duties relating to after-hours calls, home visits and nursing home visits.

- The medical centre agrees to provide the practitioner with administration services, clerical and professional staff and facilities, plant and equipment necessary for the practitioner to provide medical services to patients of the medical centre.

- Any other factors and contractual terms indicate a medical centre business is being conducted (refer Attachment 1), which requires a practitioner to be engaged to provide medical services in the manner required by the medical centre (i.e. the medical centre has operational and administrative control over the practitioner) (refer Attachment 2).

These factors are not exhaustive and the absence of one or more will not necessarily mean a relevant contract does not exist.

Footnotes

- Sections 13C, 13D and 13E (contractor provisions) and ss.13H, 13I and 13J (employment agents)

- Payroll Tax Act 2007 (NSW) Part 3, Division 7 and Payroll Tax Act 2007 (Vic), Part 3, Division 7

- Definition of ‘wages’ [1(i)] under the Schedule to the Act

- Section 14(2)(m)

- Section 14(9)

- See for example: Levitch Design Associates Pty Ltd ATF Levco Unit Trust v Chief Commissioner of State Revenue [2014] NSWCATAD 215 at [54]; Freelance Global Ltd v Chief Commissioner of State Revenue [2014] NSWSC 127 at [173]; Bridges Financial Services Pty Ltd v Chief Commissioner of State Revenue [2005] NSWSC 788 at [223][226]).

- See for example: The Optical Superstore Pty Ltd v Commissioner of State Revenue [2018] VCAT 169 at [85]-[86]; Homefront Nursing Pty Ltd v Chief Commissioner of State Revenue [2019] NSWCATAD 145 discussed at [46]-[48]; Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue [2021] NSWCATAD 259 at [38]-[41]).

- A patient who consults a practitioner engaged by a medical centre to serve patients of the medical centre is considered to be a customer of both the medical centre and the practitioner.

- Drake Personnel v Commissioner of State Revenue (Vic) (1994) 28 ATR 1082 at [46]-[48], Nationwide Towing & Transport v Commissioner of State Revenue (No. 2) (2018) 108 ATR 842 at [42]

- HIA Act, s.10(1)

- HIA Act, s.20(1)

- HIA Act, s.20A(1)

- HIA Act, s.20A(3)

- Health Insurance Commission v Peverill (1994) 179 CLR 226 at 265

- Federal Commissioner of Taxation v Rozman (2010) 186 FCR 1 at [20]-[23]

- Thomas and Naaz Pty Ltd v Chief Commissioner of State Revenue [2023] NSWCA 40, [7] and [64]

- See CFMMEU v Personnel Contracting Pty Ltd (2022) 96 ALJR 89 at [63]–[66].