Employment agent arrangement as taxable wages

Learn about payroll tax on the wages you pay workers for services provided to your clients.

You may be liable for payroll tax if you obtain and pay an individual worker to supply services to a client and:

- the worker does not become an employee of the client

- remuneration is paid or payable by you for the worker’s services

- you are entitled to receive payment from the client for the period for which the worker supplies services to that client.

Employment agent or labour hire arrangements

If an employment agent obtains a worker to provide services to a client in return for a fee, an employment agency contract is created; under this arrangement, the worker does not become an employee of the client.

The worker can provide these services individually or through a corporation or trust.

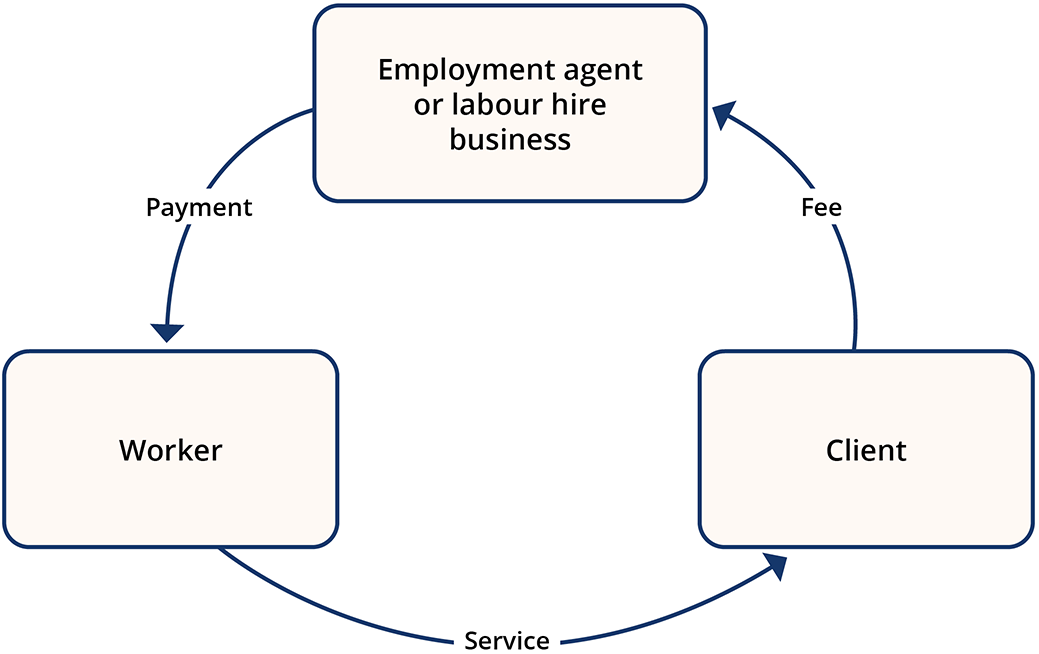

This diagram demonstrates how an employment agent arrangement works.

An employment agent arrangement usually involves the following:

- the worker contracting with the employment agent

- the employment agent contracting with the client.

An employment agency is different from a recruitment agency arrangement. See the public ruling about recruitment agencies (PTA029) for more information.

Taxable wages

An employment agent is considered the employer of the worker providing services to the employment agent’s client under an employment agency contract. The worker is deemed to be the employee of the employment agent.

The amount the agent pays under the employment agency contract, including fringe benefits and superannuation contributions, are taken to be wages. The employment agent as an employer is liable for payroll tax on wages they pay the worker directly or indirectly.

Non-taxable amounts

The following are not considered taxable wages when they are paid as part of an employment agency contract:

- GST components of a payment

- fees the client pays the agent.

Exempt wages

Where a client is exempt from payroll tax (e.g. local governments) under certain circumstances, the employment agent may be exempt, too.

The exempt client will need to provide the employment agent with a declaration by exempt client form (Form P9) each financial year. However, should the services provided by the on-hired worker to the client span more than 1 financial year, the client only needs to complete the declaration once. Read the public ruling on employment agency contracts and declaration by exempt clients (PTA026).

Using a payroll processing contractor

If you contract someone to process your payroll, you should make sure that they’re passing on any payroll tax to Queensland Revenue Office.

There have been cases where some labour-hire payroll processers were not passing on the tax, even after receiving funds from the employer. Employers then had to pay extra amounts to meet their outstanding tax liabilities, while attempting to recover what was already paid to the payroll processer.

What you should do

Before entering into a labour hire contract with a third party, you should inspect the arrangements under the contract.

If you’ve already engaged a payroll processer, ask for proof that they’re paying the payroll tax.

If you’re unsure, call 1300 300 734 for Queensland payroll tax, or contact the relevant state revenue office.

Also consider…

- Find out about chain of on-hire.

- Read about employment agents with government clients.

- Learn when an exemption is available for employment agents.