Relevant contracts and payroll tax

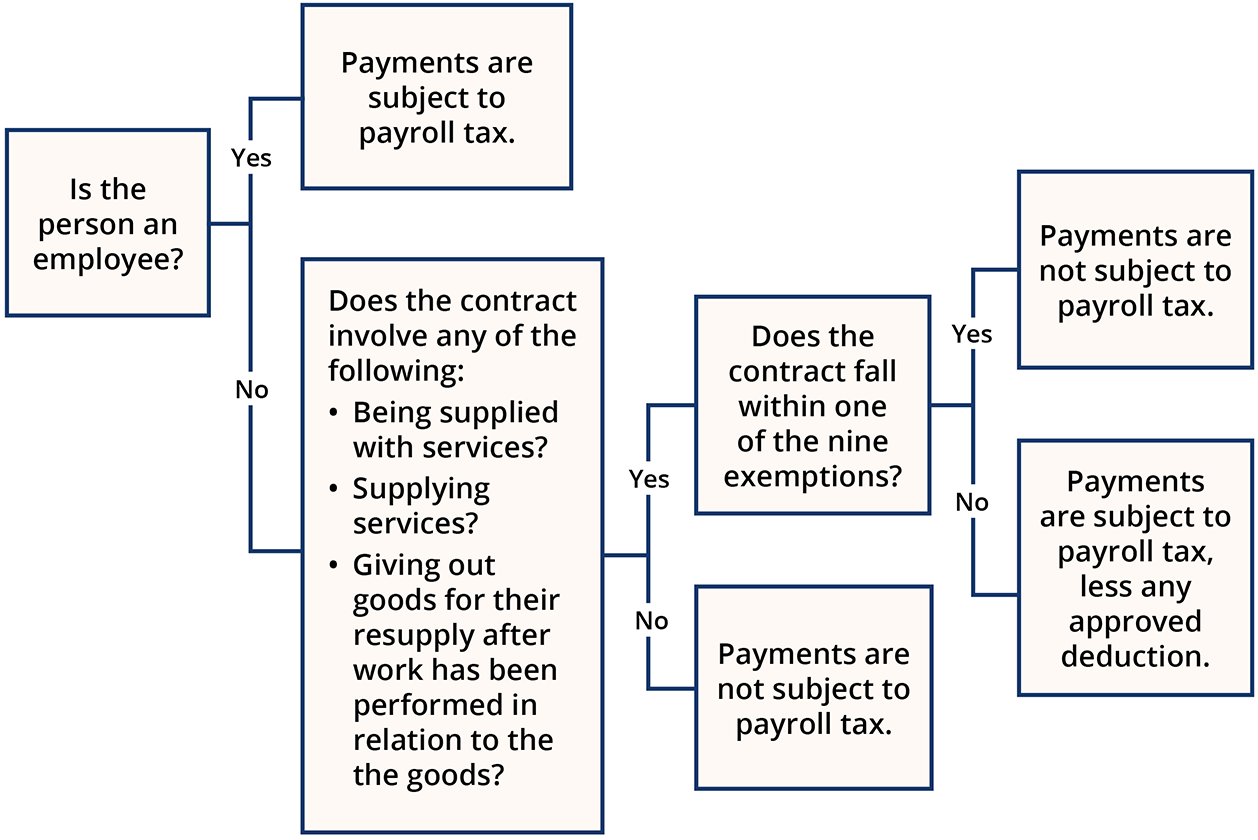

Payments you make to contractors may be taxable if your arrangement is considered a relevant contract for payroll tax purposes.

A ‘relevant contract’ is any kind of arrangement where you:

- supply services

- are supplied with services

- re-supply goods.

Re-supply means supplying goods to someone else who performs a service in relation to those goods and gives them back:

- in an altered form

- as other goods that incorporate them.

Arrangements involving services are almost always relevant contracts. These contracts are taxable unless an exemption applies. There are 9 exemptions but you need to satisfy only one of them for your payment to be exempt from payroll tax.

If the contractor payments are taxable (i.e. no exemption applies), you may still be able to claim an approved deduction for the non-labour component (goods or materials) of the payment, depending on what type of work is being performed. You should also deduct the GST component of the payment to the contractor. Otherwise, the full payment is taxable.

Before you consider whether you are paying amounts under a relevant contract, look at whether the:

- person providing services is your employee

- person’s services are provided to you by an employment agent.

If you are satisfied that neither of these apply, you can then look at whether a relevant contract exists.

Use this flowchart to help you decide how much of your payments, if any, are subject to payroll tax.

Also consider…

- Use our interactive help as a guide to determine whether contractor provisions apply.

- Read the public ruling on relevant contracts and medical centres (PTAQ000.6).